The global automotive landscape has shifted dramatically. If you are looking at the road in 2026 you will notice that the silence of electric engines is now dominated by names that were obscure just five years ago. Chinese electric vehicle manufacturers have moved beyond mere imitation and are now defining the cutting edge of battery technology, autonomous driving software, and luxury automotive design. For investors, fleet managers, and private buyers, understanding the hierarchy of BYD, NIO, and XPeng is no longer optional. It is essential for making informed decisions regarding vehicle financing, insurance planning, and portfolio management.

- The Global Market Shift in 2026

- BYD: The Volume Leader and Tech Powerhouse

- NIO: The Premium Lifestyle Brand

- XPeng: The AI and Mobility Pioneer

- Xiaomi: The Disrupter

- Zeekr: The Global Contender

- Strategic Buying Guide: Finance, Insurance, and Charging

- Future Outlook: Solid State Batteries and Beyond

- Conclusion

This guide provides a comprehensive analysis of the 2026 model lineups from China’s “Big Three” and emerging giants like Xiaomi and Zeekr. We will break down the specifications, the total cost of ownership including insurance premiums, and the technological leaps that set these cars apart from their Western competitors.

The Global Market Shift in 2026

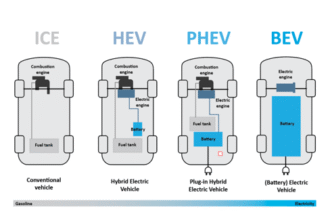

The year 2026 marks the maturity phase for Chinese EVs. We are seeing a consolidation of technology where high voltage architectures and solid state battery prototypes are finally hitting the mass market. For the consumer, this means range anxiety is effectively dead. For the investor, it means the volatility of early EV stocks is stabilizing into a battle for market share and margin efficiency.

The critical factor this year is value retention. Early concerns about Chinese EV depreciation have been mitigated by robust software updates and battery warranties. However, buyers must still navigate a complex landscape of import tariffs and varying insurance classifications depending on their region (North America, Europe, or Asia-Pacific).

BYD: The Volume Leader and Tech Powerhouse

BYD (Build Your Dreams) remains the colossal force in the sector. In 2026 they have solidified their position not just as a car manufacturer but as a battery supplier to the world. Their vertical integration allows them to control costs in a way no other competitor can match. This vertical integration is a key metric for financial analysts when evaluating EV stock potential.

The Blade Battery Advantage

The core of BYD’s success is the Blade Battery. By 2026 the evolution of this Lithium Iron Phosphate (LFP) technology has reached new heights in energy density. The safety profile of the Blade Battery reduces the risk of thermal runaway which is a significant factor in calculating commercial EV insurance rates. Insurers are increasingly favoring LFP chemistries due to their stability, potentially lowering premiums for fleet operators.

2026 Model Spotlight: Seal 08 and Sealion 08

The major news for 2026 is the expansion of the “Ocean” series.

The Seal 08 is the new flagship electric sedan. It sits above the previous Seal model, offering a more premium executive experience. It targets the same demographic as the Mercedes EQE but at a price point that undercuts it significantly.

- Range: Est. 700km+ (CLTC)

- Platform: e-Platform 3.0 Evo

- Key Feature: Disus-C intelligent body control system for superior ride comfort.

The Sealion 08 addresses the high demand for 7-seat family SUVs. This segment is crucial for families looking for electric vehicle financing options that fit a household budget while providing ample space. The Sealion 08 utilizes a 2+3+2 layout and competes directly with the Tesla Model X and Kia EV9.

- Dimensions: Approx 5040mm length.

- Tech: High-level autonomous driving assistance on highway scenarios.

Yangwang U8 and Luxury Engineering

At the top end of the spectrum is the Yangwang brand. The U8 SUV has gone viral for its ability to float on water and perform tank turns. While these features seem like novelties they demonstrate the extreme capability of BYD’s quad-motor architecture. For luxury car leasing, the Yangwang U8 represents a new tier of status symbol that rivals the G-Wagon.

NIO: The Premium Lifestyle Brand

NIO continues to position itself as the “Apple” of the EV world. Their focus is not just on the car but on the user ecosystem. In 2026 the user experience is defined by the NIO House community and the proprietary Battery as a Service (BaaS) model.

Battery as a Service (BaaS) Financials

NIO’s BaaS model allows buyers to purchase the vehicle without the battery and pay a monthly subscription fee for energy. This lowers the upfront purchase price by thousands of dollars.

- Consumer Benefit: Lower initial loan principal, resulting in lower monthly car loan payments.

- Tech Benefit: You are not stuck with degrading battery tech. You can swap to a newer, higher capacity pack (e.g., 150kWh semi-solid state) when needed.

- Insurance Implication: Some insurers offer specialized policies where the battery assets are insured separately, which can affect the comprehensive coverage quote.

2026 Model Spotlight: NIO ET9

The NIO ET9 is the definitive executive flagship launched for the 2026 model year. It is designed to compete with the Maybach and Bentley sector but with pure electric architecture.

- Architecture: 900V high-voltage system allows for incredibly fast charging (up to 255km range in 5 minutes).

- Chassis: The SkyRide fully active suspension system allows the car to shake off snow or maintain a perfectly flat ride on rough terrain.

- Interior: Executive bridge console with a 360-degree versatile tray table for rear passengers.

- Price: Starting around $112,000 USD (varies by region and BaaS selection).

The ET9 is a technological showcase that justifies high premium car insurance due to its advanced sensor suite, including LiDAR and high-definition cameras which are expensive to repair but reduce accident probability.

XPeng: The AI and Mobility Pioneer

XPeng is the choice for the tech-obsessed consumer. While BYD focuses on battery chemistry and NIO on lifestyle, XPeng focuses heavily on software and AI. Their XNGP (Navigation Guided Pilot) is widely considered the closest competitor to Tesla’s FSD (Full Self-Driving) in China.

The Flying Car Reality: Land Aircraft Carrier

In 2026 XPeng AeroHT has begun deliveries of the “Land Aircraft Carrier.” This is a modular vehicle consisting of a 6-wheel ground carrier and a detachable flying module.

- Innovation: It is the first mass-produced flying car for consumers.

- Usage: Targeted at search and rescue, high-net-worth hobbyists, and remote transport.

- Regulation: While widespread urban flight is still regulated, designated flight zones in China are opening up.

- Insurance Complexity: insuring this vehicle requires a hybrid policy covering both automotive liability and aviation hull insurance. This is a specialized high-premium market.

XPeng Robotaxi and AI

XPeng has launched Level 4 autonomous Robotaxis powered by their proprietary Turing chip. For investors, XPeng represents a play on the “AI of Things.” The data gathered from their fleet feeds into a neural network that improves the safety of their consumer vehicles like the G6 and X9.

- Fleet Management: Companies looking to electrify their delivery or transport fleets should look at XPeng’s commercial solutions which offer optimized route planning software to reduce energy consumption.

Xiaomi: The Disrupter

Xiaomi, the smartphone giant, has successfully transitioned into automotive. The Xiaomi SU7 Ultra is the performance beast of 2026.

- Performance: 1548 horsepower. 0 to 100 km/h in 1.98 seconds.

- Target: Porsche Taycan Turbo GT.

- Ecosystem: The car integrates seamlessly with Xiaomi phones and smart home devices.

The SU7 Ultra proves that consumer electronics companies can build world-class vehicles. The integration of the “Human x Car x Home” ecosystem is a major selling point.

Zeekr: The Global Contender

Zeekr (owned by Geely) is aggressive in its global expansion. The Zeekr 7X and Zeekr 9S (Plug-in Hybrid) are key models for 2026.

- Design: European styling (designed in Sweden) makes them very palatable to Western markets.

- Charging: Supports 800V charging.

- Zeekr 9S: This large SUV plug-in hybrid caters to those not yet ready for full electric, bridging the gap with extended range capabilities.

Strategic Buying Guide: Finance, Insurance, and Charging

This section is critical for anyone planning a purchase or managing a fleet of these vehicles. The cost of ownership goes beyond the sticker price.

Electric Vehicle Insurance Analysis for 2026

Insuring high-tech Chinese EVs requires understanding specific risk factors.

- Repairability: Vehicles with gigacasting (large single-piece body parts) like the Xiaomi SU7 or XPeng models can be more expensive to repair after minor collisions. This can lead to higher collision deductibles.

- Sensor Calibration: Replacing a windshield on a NIO ET9 involves recalibrating the LiDAR unit. Ensure your auto insurance policy covers “OEM parts and calibration” specifically.

- Commercial EV Insurance: For businesses deploying BYD vans or XPeng Robotaxis, look for “usage-based insurance” (UBI). These policies use the vehicle’s telematics data to reward safe driving patterns with lower premiums.

EV Financing and Loans

Interest rates for EV loans in 2026 are competitive as banks try to capture the green market.

- Green Loans: Many credit unions offer rate discounts (e.g., 0.5% reduction) for electric vehicle financing.

- Residual Value: Lease terms are becoming more favorable as the secondary market for Chinese EVs stabilizes. The residual value of a BYD Seal is holding up better than expected, making leasing a viable option compared to buying.

- Tax Incentives: Always check the latest federal and state tax credits. In 2026 some subsidies may have phased out while others for commercial utility vehicles may have increased.

Charging Infrastructure and Home Solutions

Investing in a Level 2 home charger is mandatory for optimal ownership.

- Solar Integration: Connecting your EV charger to a home solar panel system is the best way to reduce “fuel” costs to near zero.

- V2G Technology: The NIO ET9 and BYD models support Vehicle-to-Grid (V2G). This allows you to sell electricity back to the grid during peak hours, effectively offsetting your monthly car loan payment with energy arbitrage.

Future Outlook: Solid State Batteries and Beyond

The holy grail of EV tech is the solid-state battery. Dongfeng and NIO are at the forefront here. By late 2026 we expect to see limited production vehicles achieving 1000km range on a single charge with solid-state packs. This technology eliminates fire risk and drastically improves charging speed.

Investors should watch the supply chain for solid-state electrolytes. Companies securing patents in this space are the high-growth targets for the next decade.

Conclusion

The Chinese EV market in 2026 is a diverse ecosystem. BYD offers the best value and volume for the pragmatic buyer. NIO offers a luxury lifestyle and innovative battery solutions for the premium buyer. XPeng pushes the boundaries of physics and AI for the tech enthusiast.

Whether you are looking to buy your first electric car, upgrade your commercial fleet, or invest in automotive stocks, the data is clear. The innovation coming from these brands is driving the global standard. Secure your financing, compare your insurance quotes carefully, and choose the platform that fits your long-term mobility needs.

Sources: