The automotive landscape has undergone a seismic shift as we enter 2026. For years, the conversation surrounding electric vehicles was dominated by early adopters and environmental enthusiasts. Today, the discussion has transitioned into a strictly financial one. As internal combustion engines face increasing regulatory pressure and battery technology reaches a critical maturity point, every savvy consumer is asking the same question: What is the true cost of owning an electric car in 2026?

This guide provides a deep dive into the financial nuances of electric mobility. We will explore everything from purchase price parity and high value insurance premiums to the evolving world of charging infrastructure and long term maintenance. If you are considering a transition to a cleaner commute, the following data points and economic projections will serve as your essential roadmap.

The Initial Investment: Purchase Price Parity in 2026

One of the most significant developments in 2026 is the achievement of price parity between electric vehicles and traditional gasoline powered cars. Just a few years ago, the “green premium” was a major barrier to entry. However, thanks to massive scaling in manufacturing and a significant drop in raw material costs, the gap has finally closed for most vehicle segments.

Currently, the average price of a new electric sedan or compact SUV is remarkably similar to its fossil fuel counterparts. This shift is largely driven by the plummeting cost of lithium ion battery packs. In 2026, battery prices have hit a historic low of approximately 80 dollars per kilowatt hour. This represents a nearly 50 percent reduction from the prices we saw just three years ago. For a standard vehicle equipped with an 80 kilowatt hour battery, the cost of the power unit itself has dropped significantly, allowing manufacturers to pass those savings directly to the consumer.

When looking at specific models like the Tesla Model 3 or the Chevrolet Equinox EV, the sticker price is no longer the deterrent it once was. However, the initial cost is only the beginning of the financial story. In 2026, the savvy buyer must look at the total cost of ownership over a five to seven year period to truly understand the value proposition.

Financing and Green Loans for Electric Vehicles

Financing an electric car in 2026 has become more specialized. While traditional auto loans remain available, many credit unions and major banks now offer “green vehicle loans” with preferential interest rates. These financial products are designed to encourage the adoption of sustainable technology and often come with terms that are 0.5 to 1.5 percentage points lower than standard car loans.

For those looking into car loan refinancing, 2026 offers unique opportunities. As interest rates stabilize after years of fluctuation, many owners who purchased vehicles during the high interest period are finding that they can significantly lower their monthly payments. Refinancing an electric vehicle loan can be particularly lucrative if the vehicle has maintained a high residual value, which we are seeing with premium brands like Rivian and Lucid.

The Battery Factor: Longevity and Replacement Costs

The battery remains the heart of the electric vehicle, both mechanically and financially. In 2026, the fear of “battery death” has largely been replaced by data driven confidence. Most modern electric cars are now equipped with advanced thermal management systems that ensure the battery lasts for the lifetime of the vehicle, often exceeding 200,000 miles with minimal degradation.

However, for those considering the used car market, battery health is a primary concern. In 2026, a new industry of independent battery diagnostic services has emerged. These services provide a “health certificate” for used electric cars, much like a traditional mechanic inspects an engine. If a replacement is ever needed, the costs are no longer astronomical. A full battery pack replacement for a mid range vehicle now costs roughly 4,500 to 6,000 dollars, which is comparable to the cost of a major engine or transmission overhaul in a gasoline vehicle.

Insurance Realities: Why Rates Are Different for EVs

Perhaps the most surprising financial aspect of owning an electric car in 2026 is the cost of insurance. Data from recent industry reports suggests that insuring an electric vehicle can be up to 40 percent more expensive than insuring a comparable gasoline car. This disparity is driven by a few key factors:

- Specialized Repair Needs: While electric cars have fewer moving parts, the parts they do have are highly integrated and tech heavy. A minor fender bender that might cost 1,500 dollars to fix on a Honda Civic can cost double that on a Tesla due to the sensitive sensors and specialized calibration required.

- High Battery Value: Because the battery is the most expensive component, insurance companies view it as a high risk asset. If a battery is even slightly damaged in a collision, insurers are often quick to “total” the vehicle because the replacement cost, while lower than before, still represents a significant portion of the car’s value.

- Performance and Acceleration: Many electric vehicles boast incredible 0 to 60 times. From an actuarial perspective, higher acceleration often correlates with a higher frequency of high speed accidents, leading to elevated premiums.

To find the best car insurance rates in 2026, owners are encouraged to shop around and specifically look for insurers that offer “mileage based” or “telematics” policies. By allowing an insurer to track your driving habits, you can often offset the base premium increase associated with electric vehicles.

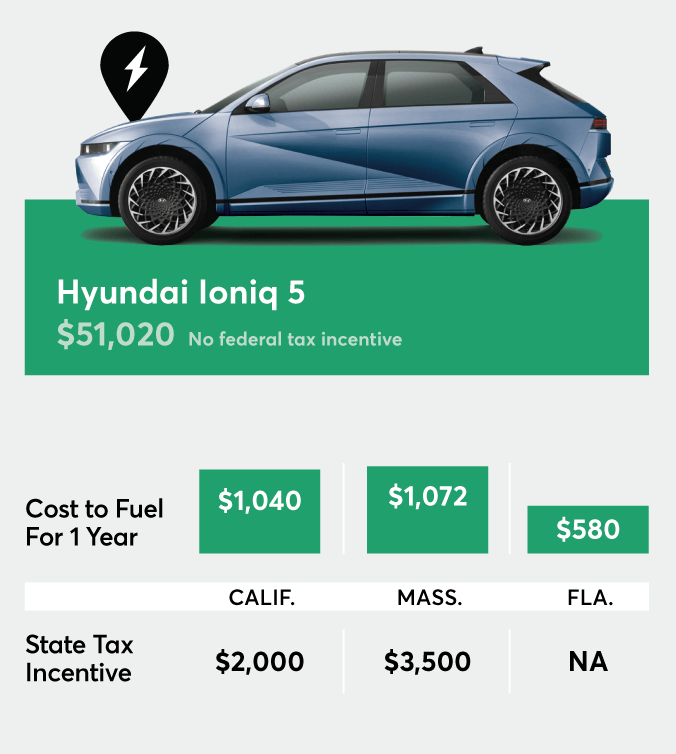

The Cost of Power: Home Charging vs Public Infrastructure

In 2026, the “fueling” economics of an electric car depend heavily on where you charge. Residential electricity rates remain the most cost effective way to power your vehicle. The national average for residential electricity is currently around 17 cents per kilowatt hour. For a typical electric car that gets 3 to 4 miles per kilowatt hour, this translates to an effective “gas price” of roughly 1.50 dollars per gallon.

However, the story changes when you hit the road. Public DC fast charging has become more expensive in 2026 as networks work to recoup the massive capital investments made in the previous years. Rates at ultra fast chargers can range from 45 cents to 60 cents per kilowatt hour. At these prices, the cost of driving an electric vehicle is nearly identical to driving a highly efficient hybrid like a Toyota Prius.

For homeowners, the initial setup for home charging is a one time expense that pays for itself quickly. Installing a Level 2 home charging station typically costs between 800 and 1,500 dollars, including labor and parts. This falls under the category of energy efficient home upgrades, which in many states still qualifies for local rebates or utility credits even after federal incentives have shifted.

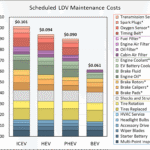

Maintenance and the Vanishing Service Visit

If there is one area where electric vehicles consistently win the financial battle, it is maintenance. In 2026, the lack of oil changes, spark plugs, timing belts, and complex exhaust systems has fundamentally changed the business model for dealerships.

The primary maintenance costs for an electric car in 2026 are:

- Tires: Due to the instant torque and the heavy weight of the battery packs, electric vehicles tend to wear through tires about 20 to 30 percent faster than gasoline cars.

- Brakes: Interestingly, the actual brake pads on an electric car can last over 100,000 miles because of regenerative braking. The vehicle uses the motor to slow down, preserving the mechanical brakes.

- Cabin Air Filters and Wiper Fluid: These remain the only “regular” service items.

Over a five year period, an electric car owner can expect to spend approximately 3,000 dollars less on maintenance compared to an internal combustion engine owner. This “invisible saving” is a massive component of the 2026 economic equation.

Tax Incentives and the 2026 Regulatory Cliff

The year 2026 marks a turning point for government incentives. Many of the generous federal tax credits that fueled the initial EV boom in the United States have either expired or been significantly reduced. As of late 2025, the broad 7,500 dollar credit has been replaced by more targeted programs that focus on domestic battery production and lower income brackets.

Prospective buyers in 2026 must be diligent in checking state specific incentives. States like California, New Jersey, and Massachusetts continue to offer robust rebate programs that can shave thousands off the purchase price. Additionally, some cities offer free parking, toll discounts, and access to HOV lanes for electric vehicle owners, which provides a “soft” financial benefit that is often overlooked.

Resale Value and Depreciation: The Year of the Used EV

Industry experts are calling 2026 “The Year of the Used EV.” A massive wave of electric vehicles that were leased during the 2023 and 2024 boom are now returning to the market as used inventory. This has created a unique dynamic: while it is bad news for original owners who see higher than expected depreciation, it is a goldmine for budget conscious buyers.

A three year old electric car in 2026 often retains about 45 to 50 percent of its original value. This is slightly lower than the resale value of luxury gasoline cars but is stabilizing as battery longevity concerns fade. For many, purchasing a used electric vehicle with a verified battery health certificate is the smartest financial move of the decade.

Safety and Legal Considerations

While we rarely think of legal costs when buying a car, the safety profiles of electric vehicles in 2026 are worth noting. Most modern electric cars are built on “skateboard” platforms that provide a low center of gravity and excellent crash protection. This often leads to fewer personal injury claims in the event of an accident. However, in the unfortunate event of a collision involving high tech components, having a specialized personal injury lawyer who understands the complexities of electric vehicle technology can be crucial. The legal landscape is still catching up to the specific liabilities associated with autonomous driving features and battery fires, though the latter remain statistically rare.

Renewable Energy Integration: The Solar Connection

One way that savvy owners are “hacking” the cost of ownership in 2026 is by integrating their vehicle with home solar systems. By investing in renewable energy solutions, homeowners can effectively “fuel” their cars for free after the initial setup costs are recouped. In 2026, bidirectional charging (Vehicle to Home or V2H) has become a standard feature on many new models. This allows your car to act as a backup battery for your house during power outages, potentially saving you thousands in separate home battery storage costs like the Tesla Powerwall.

Conclusion: Is an Electric Car Worth It in 2026?

The financial verdict for 2026 is clear: electric vehicles offer a superior total cost of ownership for high mileage drivers, particularly those who can charge at home. While the higher insurance premiums and the expiration of some federal tax credits are notable headwinds, they are outweighed by the massive savings in fuel and maintenance.

If you drive more than 12,000 miles per year and have access to a residential outlet, an electric car is almost certainly the more economical choice. However, for the low mileage driver who relies exclusively on public fast charging, the math becomes more nuanced. In 2026, the choice to go electric is no longer just about the environment; it is a calculated decision about your personal bottom line.