The global transportation landscape is currently navigating a period of unprecedented transformation. As we stand at the close of 2025, the narrative surrounding electric mobility has shifted from speculative curiosity to a fundamental industrial reality. The road toward 2035 is no longer just a timeline for environmental targets but a high stakes arena where technological supremacy, geopolitical influence, and economic resilience intersect. This comprehensive outlook examines the trajectories of the electric vehicle market, highlighting the recent shifts in policy, the breakthroughs in battery chemistry, and the massive capital flows defining the next ten years.

- The Global State of Play at the End of 2025

- Key Market Drivers and the Push Toward 2035

- Technological Breakthroughs: The Battery Revolution

- Infrastructure and the 120 Billion Dollar Investment

- Regional Market Analysis: A Tale of Three Continents

- Leading Manufacturers and Competitive Strategy

- Investment Trends and Economic Impact

- Challenges on the Horizon

- The 2035 Vision: What the Future Holds

- Conclusion

The Global State of Play at the End of 2025

As of late December 2025, the global electric vehicle market has reached a critical inflection point. Recent data indicates that the market size is projected to expand from 1.15 trillion dollars in 2024 to over 1.86 trillion dollars by 2035. This growth represents a compound annual growth rate of approximately 5.0 percent, though specific subsectors like battery electric vehicles (BEVs) are outpacing this average with a 5.8 percent growth rate.

One of the most significant developments of the current month is the recent policy update from the European Union. In a move that has sent ripples through the automotive industry, the EU has recently modified its 2035 internal combustion engine (ICE) legislation. Rather than a total 100 percent ban on tailpipe emissions, the framework now targets a 90 percent reduction. This strategic pivot allows manufacturers to continue selling certain hybrid and high efficiency internal combustion models past 2035, provided they meet strict new standards. This shift reflects the harsh economic realities facing European legacy automakers who are balancing massive research costs with intense competition from overseas.

In contrast, the market in China continues to accelerate with staggering momentum. China currently accounts for more than 56 percent of all electric vehicle sales globally. As of late 2025, nearly one out of every three cars sold in China is fully electric. The dominance of Chinese brands is not merely a domestic phenomenon. Companies like BYD have officially surpassed many Western counterparts in delivery volume, commanding nearly 20 percent of the global market share as of the last fiscal quarter.

Key Market Drivers and the Push Toward 2035

Several core drivers are propelling the industry forward as we look toward the 2035 horizon. These factors range from legislative mandates to consumer preference shifts and infrastructure scaling.

Regulatory Evolution and the Technological Neutrality Shift

The recent EU decision to ease the 2035 ban underscores a broader trend toward technological neutrality. Governments are beginning to recognize that a singular focus on battery electric vehicles might not be the only path to decarbonization. The inclusion of e-fuels and advanced hybrid systems in long term planning provides a safety net for the automotive supply chain while still maintaining a clear trajectory toward net zero goals.

In North America, the market remains more fragmented. While certain states like California continue to lead with an 18.7 percent market share for electric models, the national average in the United States has plateaued at approximately 10 percent. This is largely due to shifts in federal policy and the withdrawal of specific consumer tax credits, which has temporarily slowed the adoption rate compared to the aggressive growth seen in 2023 and 2024.

The Rise of the Electric SUV and MPV

Consumer demand is heavily skewed toward larger vehicle formats. SUVs and MPVs are projected to be the fastest growing segments through 2035, with a projected growth rate of 8.1 percent. This trend is driven by a preference for versatile vehicles that offer higher ground clearance and advanced safety features. Manufacturers are responding by prioritizing the electrification of these larger platforms, which also offer higher profit margins.

Technological Breakthroughs: The Battery Revolution

The soul of the electric car market lies in its energy storage technology. The years between 2025 and 2030 are expected to be the most innovative period in battery history.

The Emergence of Solid State Technology

Solid state batteries have long been the holy grail of the industry. As of December 2025, we are seeing the first real world applications of this technology. Mercedes-Benz has recently begun road testing EQS models equipped with semi-solid state batteries developed in partnership with Factorial. These batteries promise a significant leap in energy density, potentially increasing driving range by 50 percent or more while drastically reducing charging times.

The benefits of solid state technology include:

- Enhanced safety due to the lack of flammable liquid electrolytes.

- Faster charging capabilities with lower internal resistance.

- Longer lifespans with better resistance to thermal degradation.

- Reduced weight, which improves overall vehicle efficiency and handling.

Sodium Ion and LFP: The Path to Affordability

While solid state technology targets the premium market, sodium ion and Lithium Iron Phosphate (LFP) chemistries are democratizing electric mobility. In a major announcement on December 28, 2025, the industry leader CATL confirmed that sodium ion battery technology will be ready for large scale commercial use by the end of 2026. Sodium is far more abundant and less expensive than lithium, making it the ideal solution for budget friendly passenger cars and stationary energy storage.

LFP batteries already dominate the market in China and are increasingly used by Tesla and Ford for their standard range models. Their durability and lower cost are essential for hitting the price parity targets required for mass adoption by 2030.

Infrastructure and the 120 Billion Dollar Investment

A car is only as useful as its ability to be refueled. The global investment in charging infrastructure has surged, with cumulative funding exceeding 120 billion dollars between 2022 and 2025. This capital is being used to build high density charging corridors across Europe, North America, and Asia.

The Shift to 800V Architecture

One of the most critical technical shifts in 2025 is the move from 400V to 800V electrical architectures. Vehicles using 800V systems can charge significantly faster, often gaining 200 miles of range in under 15 minutes. This technology is becoming the standard for new premium models and is expected to trickle down to mid range vehicles by 2028.

Vehicle to Grid (V2G) and Smart Charging

The integration of cars into the electrical grid is a major trend for the 2025 to 2035 period. V2G technology allows electric cars to act as mobile batteries, feeding power back into the grid during peak demand. Recent pilot programs in Europe suggest that V2G enabled vehicles can earn owners between 400 and 1,000 dollars annually in grid service credits. This turns the vehicle from a depreciating asset into a functional component of the energy ecosystem.

Regional Market Analysis: A Tale of Three Continents

The outlook to 2035 varies significantly by region, shaped by local industry, energy costs, and government priorities.

Asia Pacific: The Manufacturing Powerhouse

The Asia Pacific region, led by China, continues to hold more than 40 percent of the global market share. Beyond manufacturing, China has built a comprehensive ecosystem that includes raw material processing, battery production, and a dense network of fast chargers. Emerging markets in Southeast Asia, such as Thailand and Indonesia, are also seeing rapid adoption as they become regional hubs for electric vehicle production.

Europe: Navigating the Transition

Europe remains the second largest market, characterized by high consumer awareness and a strong regulatory push. Despite the recent softening of the 2035 ban, the commitment to electrification remains robust. The focus in Europe is shifting toward creating a sustainable and localized battery supply chain to reduce dependence on imports. The “Green Steel” initiative and battery recycling mandates are central to Europe’s strategy of building a circular automotive economy.

North America: Resilience and Infrastructure

In North America, the transition is slower but steady. The focus is currently on “Charging Anxiety” and “Price Parity.” The expansion of the Tesla Supercharger network to other brands through the NACS standard has been a pivotal moment in 2025, providing a much needed boost to consumer confidence. The market is expected to see a significant rebound in the late 2020s as more affordable domestic models enter the production line.

Leading Manufacturers and Competitive Strategy

The competitive landscape is being redrawn. Legacy automakers are no longer just competing with each other but with agile tech focused firms.

| Manufacturer | Global Market Share (2025) | Key Strategy |

| BYD | 19.9% | Vertical integration and affordable LFP technology |

| Tesla | 7.7% | Software excellence and global charging infrastructure |

| Geely | 10.2% | Multi brand strategy and global expansion |

| Volkswagen | 6.7% | Transitioning legacy platforms to scalable EV architectures |

| Hyundai & Kia | 4.4% | Leadership in 800V fast charging technology |

BYD has emerged as the dominant force, with over 2.6 million deliveries in the first eight months of 2025 alone. Their ability to manufacture almost every component of the vehicle in house gives them a significant cost advantage. Tesla remains the benchmark for software and autonomous driving, though it has faced increased pressure in the mass market segments.

Investment Trends and Economic Impact

The shift to electric mobility is one of the largest capital reallocations in industrial history. Investors are looking beyond the car manufacturers themselves and focusing on the broader ecosystem.

- Mining and Materials: The demand for lithium, cobalt, nickel, and copper remains high, but there is an increasing focus on sustainable mining and “Battery Passports” to track the ethical origin of materials.

- Semiconductors: Modern electric cars require significantly more chips than traditional vehicles, driving growth in the automotive semiconductor sector.

- Energy Management: Software companies specializing in grid integration and fleet management are seeing record venture capital interest.

The global workforce is also evolving. Over 6 million people are now employed in the electric vehicle sector, with 330,000 new roles added in the last year alone. This talent shift is moving from mechanical engineering toward software development, chemical engineering, and data science.

Challenges on the Horizon

Despite the optimistic outlook, several hurdles remain between now and 2035.

- Raw Material Volatility: While sodium ion batteries offer a long term solution, the industry is still heavily dependent on lithium. Fluctuations in commodity prices can impact vehicle affordability.

- Grid Capacity: The rapid addition of millions of high power chargers requires significant upgrades to local power grids.

- Resale Value: Early electric models have seen higher depreciation rates than their internal combustion counterparts. Improving battery health diagnostics is essential for stabilizing the used car market.

- Geopolitical Tensions: Trade barriers and tariffs, such as those recently implemented between the EU and China, could slow the global exchange of technology and drive up costs for consumers.

The 2035 Vision: What the Future Holds

By 2035, the automotive world will look radically different. We expect that by this time:

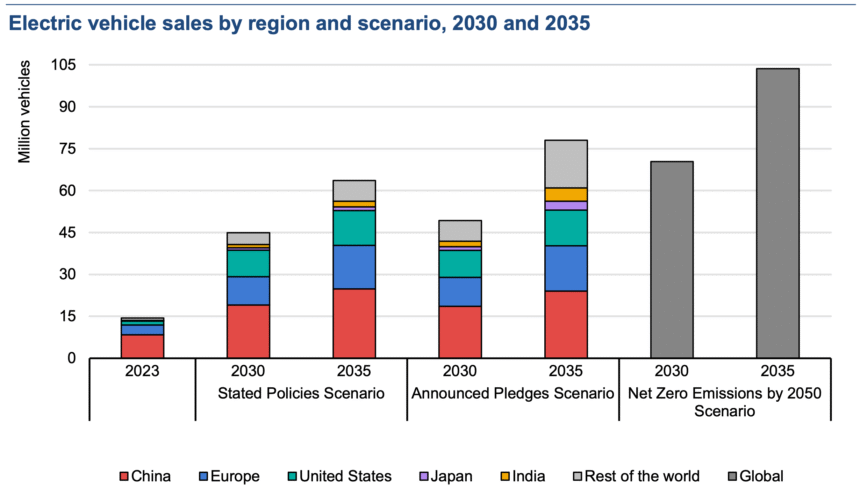

- Electric vehicles will account for more than 50 percent of new car sales globally.

- Solid state batteries will be standard in premium and long range models.

- Autonomous driving features will be deeply integrated with electric platforms, particularly in urban “robotaxi” fleets.

- The concept of the “gas station” will have largely been replaced by a mix of home charging, workplace hubs, and ultra fast highway charging plazas.

- A circular economy for batteries will be fully operational, with over 90 percent of materials from retired vehicles being recycled into new packs.

Conclusion

The electric car market outlook to 2035 is defined by resilience and innovation. While the road has become more complex with shifting regulations and geopolitical tensions, the underlying momentum is irreversible. The combination of falling battery costs, superior vehicle performance, and the urgent need for sustainable transport ensures that the next decade will be the most transformative in the history of the automobile.

For investors, policymakers, and consumers, the message is clear: the transition is no longer a matter of “if” but “how fast.” As we move past the milestones of 2025, the focus turns toward scaling the solutions that will define mobility for the next century.