The automotive landscape has reached a historic fever pitch as we close out the final days of 2025 and transition into 2026. For anyone who has been sitting on the fence regarding the switch to electric mobility, the current market dynamics represent a unique alignment of economic factors. We are witnessing a monumental shift where manufacturer desperation, technological breakthroughs, and evolving trade policies have created a buyer’s market unlike any seen since the early days of the internal combustion engine.

- The End of the Federal Era and the Rise of Manufacturer Rebates

- Tesla’s Strategic Inventory Clear-Out: 0% APR and Free Upgrades

- The Used Market Crash: A Goldmine for Value Hunters

- Battery Technology and the 20% Price Reduction

- Charging Infrastructure: The Hidden Incentive

- Total Cost of Ownership: The Real Math of 2026

- Global Trade Dynamics and the 2026 Tariff Outlook

- Summary of Live Daily Updates for December 30, 2025

- Strategic Buying Advice for the New Year

- Conclusion: The Window of Opportunity

The End of the Federal Era and the Rise of Manufacturer Rebates

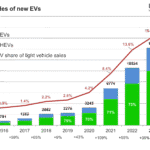

For years, the primary driver of electric vehicle adoption in the United States was the robust federal tax incentive program. However, as of late 2025, the legislative landscape has undergone a seismic shift. The traditional $7,500 tax credit, which served as the bedrock of the industry, has officially sunsetted for many buyers under new budgetary guidelines. While this initially caused a ripple of concern among prospective owners, the industry response has been nothing short of extraordinary.

Major automakers including Ford, General Motors, and Hyundai have stepped into the vacuum left by the federal government. To maintain the sales momentum established over the last three years, these companies are now offering direct manufacturer incentives that often exceed the previous government subsidies. For instance, Hyundai has recently announced a staggering $9,800 price adjustment on select trims of the 2026 Ioniq 5. This move is designed to keep the effective cost of the vehicle below the $40,000 threshold, which remains a critical psychological and financial barrier for the average American household.

Tesla’s Strategic Inventory Clear-Out: 0% APR and Free Upgrades

Tesla remains the dominant force in the North American market, and their end-of-year strategy for 2025 has set a new benchmark for affordability in the premium segment. As we approach the first quarter of 2026, the company has launched a multi-pronged incentive program aimed at clearing current inventory. The most notable offer is the introduction of 0% APR financing for up to 72 months on the Model 3 and Model Y. In an era of fluctuating interest rates, the ability to finance a high-performance vehicle with no interest represents a savings of several thousand dollars over the life of the loan.

Furthermore, the “Free Upgrade” program has been expanded. Buyers can now select premium paint colors like Ultra Red or Quicksilver, or opt for the 20-inch Induction wheels and white interior packages at no additional cost. These options typically carry a price tag ranging from $1,000 to $2,500. For those preferring to lease, the $0 down payment option on the Model Y has made it one of the most accessible luxury crossovers on the market today.

The Used Market Crash: A Goldmine for Value Hunters

One of the most significant developments in late 2025 is the correction in the pre-owned electric car market. As high volumes of leased vehicles from the 2022 and 2023 peak years return to dealer lots, the supply of used electric cars has surged. This has resulted in a significant drop in resale values, which is a boon for secondary market buyers.

The Tesla Model 3 has seen its average used price dip to approximately $23,000 for well-maintained units with reasonable mileage. This price point is particularly attractive because it allows buyers to access cutting-edge technology and a robust charging network at the cost of a basic gasoline-powered compact car. Other models, such as the Chevrolet Bolt and the Nissan Leaf, are appearing on the market for under $15,000, making them ideal candidates for urban commuters or multi-car households looking to reduce their carbon footprint without a massive capital investment.

Battery Technology and the 20% Price Reduction

The primary cost driver of any electric vehicle is the battery pack. In a significant victory for engineering and supply chain management, battery prices have plummeted by roughly 20% over the last calendar year. This decline is largely attributed to the widespread adoption of Lithium Iron Phosphate (LFP) chemistry. LFP batteries are not only cheaper to produce because they avoid expensive materials like cobalt and nickel, but they also offer superior longevity and safety profiles.

For the 2026 model year, several manufacturers are transitioning their base models to LFP chemistry. This shift allows them to lower the Manufacturer’s Suggested Retail Price (MSRP) while maintaining or even improving the vehicle’s durability. We are now seeing the first generation of “million-mile” batteries entering the mainstream, which fundamentally changes the total cost of ownership equation. When a vehicle’s primary component is rated to outlast the chassis itself, the long-term value proposition becomes undeniable.

Charging Infrastructure: The Hidden Incentive

While sticker prices and rebates get the headlines, the expansion of the charging infrastructure is a powerful “soft” incentive that is reaching maturity in 2026. The integration of the North American Charging Standard (NACS) across nearly all major brands has simplified the ownership experience. Drivers of Ford, Rivian, and GM vehicles now have seamless access to the Supercharger network, significantly reducing “range anxiety.”

Moreover, local utility companies have become aggressive in their push for home charging. Many providers are offering rebates of up to $1,000 for the installation of Level 2 smart chargers. When combined with “time-of-use” electricity rates, the cost of “fueling” an electric vehicle has dropped to a fraction of the cost of gasoline. In many states, the equivalent cost of electricity for an electric car is now under $1.50 per gallon of gasoline, providing a continuous financial incentive that accumulates every mile you drive.

Total Cost of Ownership: The Real Math of 2026

To truly understand the value of the current price drops, one must look at the Total Cost of Ownership (TCO). A standard 2026 electric sedan with an MSRP of $42,000 may seem more expensive than a $32,000 gasoline counterpart on the surface. However, when you factor in the $7,500 manufacturer rebate, the 0% financing, and the elimination of oil changes, transmission repairs, and spark plug replacements, the electric option often becomes the cheaper choice within the first 24 months of ownership.

Insurance companies have also begun to adjust their premiums as repair methodologies for electric vehicles become more standardized. While early electric cars were often expensive to insure due to unknown repair costs, the 2026 data shows that premiums are now reaching parity with high-end internal combustion vehicles.

Global Trade Dynamics and the 2026 Tariff Outlook

As we look toward the middle of 2026, new trade policies and tariffs are expected to impact the pricing of imported components and vehicles. This creates a “buy it now” window for late 2025 and early 2026. Automakers are currently working through existing stockpiles of components that were imported under previous, more favorable trade agreements. Once these inventories are exhausted, the costs of manufacturing may rise slightly, potentially leading to a plateau or minor increase in MSRPs later in the year.

Smart shoppers are currently prioritizing vehicles with high North American content to insulate themselves from these potential price hikes. The 2026 Chevrolet Equinox EV and the Ford F-150 Lightning are prime examples of vehicles that leverage local supply chains to maintain competitive pricing despite global economic volatility.

Summary of Live Daily Updates for December 30, 2025

For those tracking the market on a daily basis, here are the critical figures for today:

- Tesla Model Y Inventory Discount: Up to $4,500 off MSRP for immediate delivery.

- Ford Mach-E Financing: 0.9% APR for 60 months plus a $2,000 “Summer of EV” bonus.

- Hyundai Ioniq 6 Lease: $249 per month with $3,499 due at signing.

- Average National Electricity Rate for EV Charging: $0.16 per kWh.

- Public Charging Availability: Over 190,000 compatible ports now live across the U.S. and Canada.

Strategic Buying Advice for the New Year

If you are planning to purchase an electric car in 2026, the strategy should be focused on maximizing the manufacturer-to-dealer incentives. Unlike previous years where the government did the heavy lifting, the savings are now found in the “trunk money” and financing terms offered at the dealership level. Negotiating on the “Out the Door” price is more effective than ever, as dealers are motivated to hit volume targets to secure future allocations of high-demand hybrid and electric models.

Always verify the production date of the vehicle. Models produced in late 2025 often carry the most aggressive incentives as showrooms make room for the 2026 refreshes. These “leftover” new cars are the sweet spot of the current market, offering the latest technology with deep, cleared-out pricing.

Conclusion: The Window of Opportunity

The transition to electric transport is no longer a futuristic concept but a present-day reality driven by cold, hard economics. The price drops and incentives of 2026 represent a maturation of the market. We have moved past the “early adopter” phase and entered a period of mass-market competition. For the consumer, this competition is the ultimate incentive. By leveraging manufacturer rebates, taking advantage of the used market correction, and utilizing the expanding charging infrastructure, drivers can now enjoy a superior driving experience at a lower cost than traditional alternatives.

Whether you are looking for a high-performance luxury sedan or a practical family crossover, the final days of 2025 and the start of 2026 offer a rare window to secure a vehicle that is cheaper to buy, cheaper to run, and better for the planet.

Sources for Live Tracking and Incentives

For those who wish to verify the latest daily data and regional offers, please consult the following authoritative resources: