The automotive landscape of late 2025 represents a definitive turning point in how consumers perceive mobility. As we close out the fourth quarter, the industry is navigating a complex intersection of high transaction prices, evolving powertrain technologies, and a fundamental shift in segment loyalty. For years, the narrative was dominated by the seemingly unstoppable ascent of the Sport Utility Vehicle (SUV). However, the data from December 2025 reveals a much more nuanced picture. While SUVs continue to command a massive share of the global market, both trucks and sedans are finding new ways to assert their relevance in a cautious economic climate.

- The Dominance of the Modern SUV Segment

- The Truck Paradigm: Lifestyle Vehicles vs. Workhorses

- The Sedan Renaissance: Efficiency and Gen Z Preferences

- Comparative Analysis: Safety, Tech, and Value Retention

- The Hybrid Bridge: A 2025 Course Correction

- Regional Growth Patterns and Global Insights

- Looking Ahead to 2026 and 2027

- Conclusion: Choosing the Right Segment in 2025

The Dominance of the Modern SUV Segment

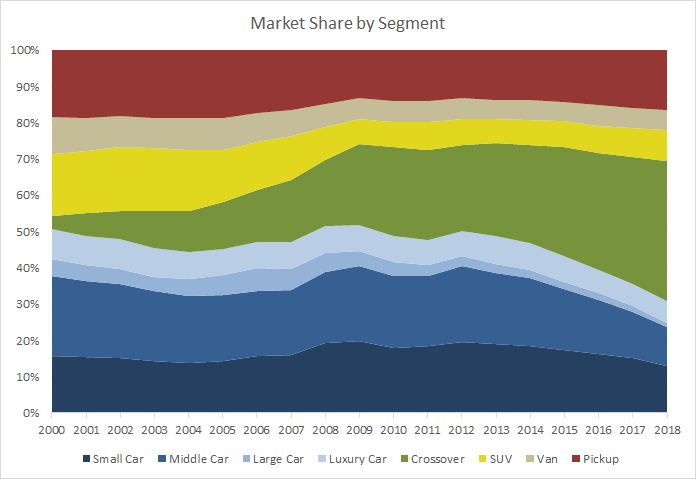

The SUV remains the primary driver of automotive growth in 2025. According to recent market intelligence reports, the global SUV market size was valued at over 51 billion dollars at the start of the year and is projected to grow at a compound annual growth rate (CAGR) of 4.48 percent through 2032. This sustained growth is not just about size; it is about versatility.

The Crossover Phenomenon and Urban Utility

Compact and mid-sized SUVs, often referred to as crossovers, have effectively become the new family car. In 2024, compact SUVs accounted for nearly 43 percent of the total SUV market share. This dominance has continued into 2025 because these vehicles offer a specific balance that urban and suburban drivers crave. They provide the elevated seating position and cargo flexibility of a traditional truck based SUV but maintain the fuel efficiency and maneuverability of a passenger car.

Manufacturers like Toyota and Honda have seen record sales with models like the RAV4 and CR-V. These vehicles are no longer just utilitarian boxes. They are now rolling showcases for hybrid technology. In fact, the hybrid-only sixth-generation RAV4, which hit dealerships late this year, has already set new benchmarks for pre-orders.

Luxury SUV Expansion and High Net Worth Demand

The luxury SUV sub-segment is where the most significant financial growth is occurring. Research from Technavio and Mordor Intelligence suggests that the luxury SUV market is expanding at an even faster rate of approximately 11.8 percent. This growth is largely fueled by the increasing number of high net worth individuals in regions like North America and the Asia-Pacific.

Luxury buyers in 2025 are looking for more than just a badge. They are demanding advanced driver assistance systems (ADAS), artificial intelligence integrated cabins, and ultra-premium materials. Vehicles like the BMW X7, Mercedes-Benz GLS, and the latest Range Rover models are not just transportation; they are status symbols that offer mobile office capabilities. The rise of the coupe-style SUV, which combines the aggressive roofline of a performance car with the stance of an SUV, is another trend that has gained massive traction in the premium market this year.

The Truck Paradigm: Lifestyle Vehicles vs. Workhorses

Trucks have long been the backbone of the North American automotive market. As of late 2025, the Ford F-Series remains the best-selling vehicle in the United States, with nearly 600,000 units sold through the first three quarters. However, the truck segment is undergoing its own internal revolution.

The Peak Truck Theory

Interestingly, some analysts from the Dave Cantin Group have suggested that the market may have reached “Peak Truck.” This theory posits that as vehicle prices continue to rise, the traditional truck buyer is being priced out of the market. The average transaction price for a new vehicle in late 2025 sits at just over 49,000 dollars, but full-size pickups often exceed 70,000 dollars when equipped with modern technology and luxury packages.

This has led to a fascinating split in the segment. On one hand, you have the heavy-duty workhorses used by commercial fleets and tradespeople. On the other hand, you have the lifestyle trucks. Models like the Ford Maverick have seen an 11 percent improvement in sales because they offer truck utility at a price point that is accessible to younger buyers and urban dwellers.

The Electric Truck Revolution

The electrification of the truck segment has been one of the most watched trends of 2025. While the initial hype around electric pickups was immense, the reality of the market has been more grounded. Buyers are praising the instant torque and “frunk” storage of vehicles like the Chevrolet Silverado EV and the Ford F-150 Lightning, but concerns about towing range and charging infrastructure in rural areas remain.

Despite these hurdles, the Silverado HD and other heavy-duty variants have seen a 19 percent rise in year-to-date sales. This indicates that while the personal-use truck market might be cooling slightly due to price sensitivity, the demand for high-capability vehicles for towing and commercial use remains robust.

The Sedan Renaissance: Efficiency and Gen Z Preferences

For a decade, the death of the sedan was predicted by almost every major automotive analyst. Yet, in December 2025, the four-door passenger car is proving to be remarkably resilient. Sedans currently account for about 18.4 percent of new retail registrations, a figure that has held steady even as SUVs grew.

The Affordability Factor

The primary driver behind the sedan’s survival is affordability. In an era where interest rates and insurance premiums are high, the sedan offers a lower entry point for the average consumer. Vehicles like the Nissan Sentra and the Toyota Camry continue to see strong sales because they offer superior fuel economy and lower total cost of ownership compared to equivalent SUVs.

The Nissan Sentra, for example, saw sales rise 16 percent in the third quarter of 2025. For many buyers, the decision is purely mathematical. A sedan typically weighs less, has better aerodynamics, and requires less expensive tires and brakes than a heavy SUV. This translates to hundreds of dollars in savings every year.

Youthful Appeal and Aesthetic Shifts

Perhaps the most surprising trend of 2025 is the interest from Generation Z. Data from Experian suggests that younger buyers are over-indexing in the sedan segment. For Gen Z, the SUV is the “parent car.” The sedan represents something sleeker, more personal, and more aligned with an urban lifestyle where parking is at a premium.

Furthermore, the shift toward electric sedans has revitalized the segment’s image. The Tesla Model 3 and the Hyundai Ioniq 6 have proven that a sedan can be a high-tech performance machine. These vehicles take advantage of their lower profile to achieve better aerodynamic efficiency, which is a critical factor for maximizing battery range.

Comparative Analysis: Safety, Tech, and Value Retention

When comparing these three segments in the current 2025 market, several key factors influence consumer decision-making.

Advanced Safety and Technology

In 2025, safety technology has become standardized across all segments. However, the way it is implemented varies. SUVs and trucks often utilize their larger footprints to incorporate more sensors for 360-degree cameras and advanced towing assistance.

Trucks in 2025 now feature AI-assisted hitching and trailer maneuvering systems that were unthinkable a decade ago. SUVs, meanwhile, are focusing on “interior safety,” such as rear-occupant alerts and biological sensors that can detect a driver’s fatigue levels. Sedans, being lower to the ground, are leading the way in pedestrian safety technology and high-speed stability controls.

Resale Value and Total Cost of Ownership

The financial aspect of vehicle ownership is more critical in 2025 than ever before. Historically, trucks have held their value better than any other segment. This remains true today, especially for mid-size trucks like the Toyota Tacoma and Ford Ranger.

SUVs follow closely behind, particularly three-row models that are always in high demand on the used market. Sedans generally see higher depreciation, but this makes them the stars of the Certified Pre-Owned (CPO) market. For a buyer looking for a three-year-old vehicle with a full warranty, a CPO luxury sedan often provides the best value-to-luxury ratio in the current market.

The Hybrid Bridge: A 2025 Course Correction

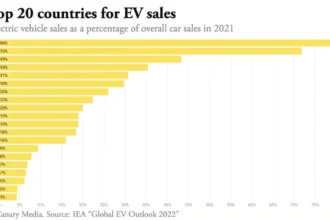

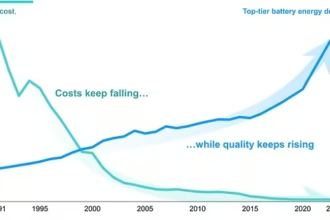

One of the most significant takeaways from the end-of-year 2025 data is the “Hybrid Bridge.” While the industry is moving toward a fully electric future, the transition has slowed. Global electric vehicle (EV) sales growth settled at around 18 percent this year, down from the explosive 35 percent growth seen in previous years.

In its place, hybrid and plug-in hybrid (PHEV) sales have surged. Consumers are choosing hybrids because they offer the fuel savings of an EV without the “range anxiety” associated with a still-developing charging network. This trend is visible across all segments. Hybrid SUVs like the Kia Sportage and hybrid trucks like the Ford Maverick are leading their respective categories in growth.

Regional Growth Patterns and Global Insights

The growth of these segments is not uniform across the globe.

Asia-Pacific Dominance

The Asia-Pacific region remains the largest market for SUVs, holding over 38 percent of the global share. Rapid urbanization in China and India has led to a massive demand for sub-compact SUVs that can navigate crowded city streets while offering the status associated with a larger vehicle.

The North American Stronghold

North America continues to be the primary market for full-size trucks and luxury SUVs. The culture of the “road trip” and the necessity of towing for recreational activities like boating and camping ensure that these high-margin vehicles remain the focus for domestic manufacturers like General Motors, Ford, and Stellantis.

European Efficiency

In Europe, the shift is more focused on the “crossover” segment and high-efficiency sedans. Stricter CO2 regulations and urban access fees have made large, traditional SUVs less practical. As a result, European manufacturers are leading the charge in developing ultra-aerodynamic electric sedans and compact electric crossovers.

Looking Ahead to 2026 and 2027

As we peer into the future of the automotive industry, several “radar signals” indicate where the market is headed.

Software-Defined Vehicles

The next two years will see the rise of the software-defined vehicle (SDV). This means that the hardware (the segment of the car) will become less important than the software experience inside. Whether you drive a truck, a sedan, or an SUV, your car will receive over-the-air (OTA) updates that improve performance, add new safety features, and provide personalized entertainment.

Solid-State Battery Integration

By 2027, we expect to see the first commercial applications of solid-state batteries. This technology will be a game-changer for all segments but will be particularly impactful for trucks and large SUVs. The increased energy density will allow these heavy vehicles to achieve ranges exceeding 500 miles on a single charge, potentially removing the final barrier to full-scale electrification in the heavy-duty segment.

The Rise of Subscription Models

Another trend to watch is the shift from ownership to “usership.” Especially in urban centers, more consumers are opting for subscription-based access to vehicles. This allows a driver to use a fuel-efficient sedan for their daily commute but swap it for a rugged SUV for a weekend mountain trip. This flexibility could fundamentally change how manufacturers report “sales” by segment.

Conclusion: Choosing the Right Segment in 2025

The decision between an SUV, a sedan, or a truck in late 2025 ultimately comes down to a balance of lifestyle needs and financial pragmatism.

SUVs remain the king of versatility, offering a “do-it-all” solution for families and adventure seekers. Trucks continue to dominate in terms of utility and status, though their high price points are creating a shift toward more compact, efficient models. Sedans are enjoying a quiet but firm resurgence, driven by a new generation of buyers who value efficiency, affordability, and sleek design.

As the industry moves forward, the lines between these segments will continue to blur. We are already seeing “adventure sedans” with increased ground clearance and “luxury trucks” with interiors that rival high-end limousines. In this evolving market, the winner is the consumer, who has more choices, more technology, and more efficiency available than at any other point in automotive history.

https://kentshield.online/category/news/ev-market-growth-reports