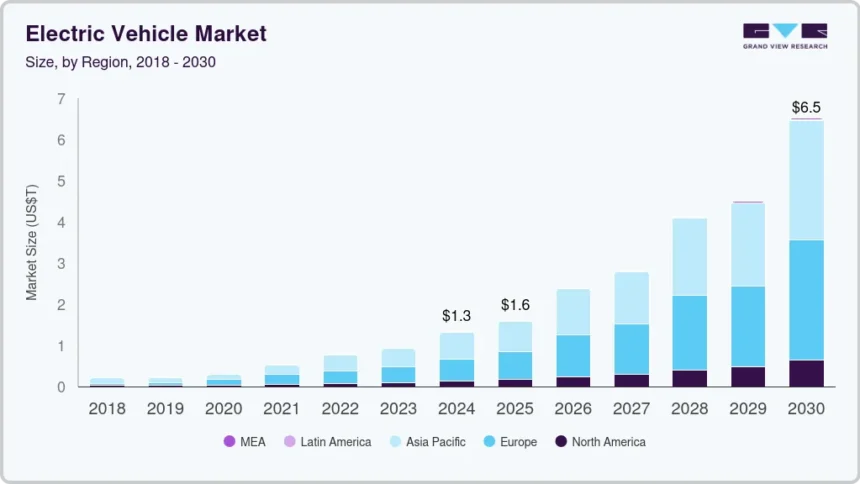

The global automotive landscape is undergoing its most radical transformation since the introduction of the assembly line. As we look toward 2027, the fusion of sustainable energy, artificial intelligence, and advanced material science is set to redefine not just how we drive, but how we interact with the concept of mobility itself. Current market data suggests that the momentum behind electric vehicles (EVs) is no longer a localized phenomenon but a global economic shift, with global sales projected to reach 30 million units by 2027 (Lagos et al., 2023).

- 1. The Commercial Debut of Solid-State Batteries

- 2. Global Price Parity with Internal Combustion Engines

- 3. The Rise of the $25,000 “Mass Market” EV

- 4. China’s Continued Global Dominance and Export Surge

- 5. Integration of Level 4 Autonomous Driving in Luxury EVs

- 6. The 1,200 km Range Milestone

- 7. Smart Charging and Vehicle-to-Grid (V2G) Evolution

- 8. Accelerated Build-out of Public Charging Networks

- 9. Circular Economy: The Standardization of Battery Recycling

- 10. The Decline of the Plug-in Hybrid (PHEV)

- Conclusion

This comprehensive analysis explores the top ten predictions for the electric vehicle sector in 2027, drawing on the latest industrial breakthroughs, manufacturing trends, and policy shifts.

1. The Commercial Debut of Solid-State Batteries

For years, solid-state batteries (SSBs) have been the “holy grail” of the automotive industry. By 2027, this technology is expected to move from the laboratory to the production line. Leading manufacturers like Toyota have confirmed plans to start producing SSB-equipped vehicles in the 2027 to 2028 timeframe (Peplow, 2025).

Unlike traditional lithium-ion batteries that use liquid electrolytes, SSBs utilize solid electrolytes (typically oxides or sulfides). This shift promises to solve the primary hurdles of current EV adoption:

- Safety: The removal of flammable organic electrolytes significantly reduces thermal runaway risks (Peplow, 2025).

- Performance: These batteries are projected to offer energy densities exceeding 500 Wh/kg, nearly double that of current high-end lithium-ion cells (Salgado et al., as cited in Lagos et al., 2023).

- Charging Speed: Breakthroughs suggest an 80% charge can be achieved in as little as 10 minutes (Peplow, 2025).

2. Global Price Parity with Internal Combustion Engines

One of the most significant barriers to EV adoption has been the “green premium” or the higher upfront cost compared to traditional vehicles. However, the economic scales are tipping. Industry experts anticipate that EVs will reach true price parity with traditional gasoline and diesel vehicles as battery costs fall below $100 per kWh, a milestone conservatively projected to occur between 2025 and 2030 (Kolpakov, 2020).

By 2027, the total cost of ownership (TCO) for a battery electric vehicle is expected to fall below the benchmark for internal combustion engine (ICE) vehicles in most major markets (DergiPark, 2025). This shift is driven by a median lithium-ion pack price that fell to approximately $115 per kWh in 2025, marking the steepest annual drop in nearly a decade (DergiPark, 2025).

3. The Rise of the $25,000 “Mass Market” EV

For the transition to be successful, electric mobility must be accessible to the average consumer, not just luxury buyers. By 2027, we expect a surge in affordable, high-quality electric vehicles priced at or below $25,000.

Market indicators show that total EV affordability reached a critical tipping point in late 2023 (Center for Automotive Research, 2024). Manufacturers are now utilizing “roll-to-roll” manufacturing techniques and AI-driven material discovery to optimize production costs, specifically targeting the high-volume small and compact car segments (Lagos et al., 2023).

4. China’s Continued Global Dominance and Export Surge

China has already established itself as the global leader in the EV sector, and its lead is only expected to widen by 2027. China is projected to account for approximately 40% of global EV sales by 2030, with sales hitting roughly 16 million units annually by that time (BBVA Research, 2023).

By 2027, China’s export strategy will be in full swing. In 2022, China’s EV exports grew at an average annual rate of 292%, trailing only Germany in total value (BBVA Research, 2023). With massive investments in charging infrastructure and a national strategy prioritizing EV adoption, Chinese brands are set to become household names across Europe and Southeast Asia by 2027.

5. Integration of Level 4 Autonomous Driving in Luxury EVs

The synergy between electric drivetrains and autonomous software is undeniable. While fully autonomous (Level 5) vehicles may still be on the horizon, Level 4 functionality is predicted to become a standard feature in the luxury EV segment by 2027.

Level 4 capabilities, which allow the vehicle to operate without human intervention in specific environments, will initially diffuse through larger luxury car segments before trickling down to the medium and compact markets (Kolpakov, 2020). This integration is expected to revolutionize urban commuting, potentially shifting consumer preference toward “autonomous vehicle-on-demand” (AVoD) models that offer lower costs than current car-sharing services (Deutsches Zentrum für Luft- und Raumfahrt, 2014).

6. The 1,200 km Range Milestone

“Range anxiety” is set to become a term of the past. With the introduction of semi-solid and fully solid-state batteries, manufacturers are targeting driving ranges that far exceed current gasoline-powered cars. Toyota has announced the development of an EV capable of a 1,200 km range (approximately 745 miles) by the 2027-2028 window (JRC Publications, 2024). This would effectively double the average range of current long-range electric vehicles, making EVs viable for even the most remote long-distance travel.

7. Smart Charging and Vehicle-to-Grid (V2G) Evolution

By 2027, EVs will no longer be just consumers of energy; they will be active participants in the energy grid. Smart charging infrastructure will allow vehicles to coordinate their demand based on grid stability and the availability of renewable energy (Lagos et al., 2023).

Vehicle-to-Grid (V2G) technology will enable EV owners to sell excess energy back to the grid during peak demand periods. This integration is critical for maintaining grid reliability as intermittent renewable sources like wind and solar become more prevalent (MDPI, 2025).

8. Accelerated Build-out of Public Charging Networks

The success of the EV market depends heavily on the “visibility” of charging infrastructure. Projections indicate a massive scale-up of public rapid charging stations by 2027 to meet the demands of a growing global fleet (Lagos et al., 2023).

Government policies, such as the requirement for road upgrades to incorporate charging infrastructure, are becoming common in developed economies (AEMO, 2022). By 2027, the density of chargers in urban areas is expected to rival that of traditional gas stations, significantly reducing the “social barrier” to EV adoption (Lagos et al., 2023).

9. Circular Economy: The Standardization of Battery Recycling

As the first generation of mass-market EVs reaches the end of its life cycle, 2027 will see the formalization of the “battery circular economy.” Regulatory frameworks are already being developed to ensure the efficient collection and processing of solid-state and lithium-ion batteries (MDPI, 2024).

Advances in recycling technology will focus on recovering critical minerals like lithium, cobalt, and nickel. This not only reduces the environmental footprint of EV production but also stabilizes the supply chain against the volatility of raw material prices (DergiPark, 2025).

10. The Decline of the Plug-in Hybrid (PHEV)

As battery electric vehicle (BEV) technology improves in terms of range and charging speed, the need for a “bridge technology” like the Plug-in Hybrid (PHEV) is expected to diminish. By 2027, market share for pure BEVs is projected to grow at a faster rate than hybrids as consumer confidence in charging infrastructure reaches a critical mass (AEMO, 2024).

The simplification of the drivetrain in pure EVs offers lower maintenance costs and higher efficiency, leading many manufacturers to shift their R&D budgets exclusively toward all-electric platforms by the end of 2027 (Klier & Rubenstein, 2022).

Conclusion

The year 2027 stands as a pivotal moment in automotive history. It represents the point where the technological breakthroughs of the early 2020s—specifically in solid-state chemistry and autonomous integration—finally reach the hands of the general public. As price parity is achieved and infrastructure expands, the transition to electric mobility will shift from an elective choice to an economic and environmental necessity.

References

- AEMO. (2022). Electric vehicle projections 2022. https://www.aemo.com.au/-/media/files/stakeholder_consultation/consultations/nem-consultations/2022/2023-inputs-assumptions-and-scenarios-consultation/supporting-materials-for-2023/csiro-2022-electric-vehicles-projections-report.pdf

- AEMO. (2024). Electric vehicle projections 2024. https://www.aemo.com.au/-/media/files/major-publications/isp/2025/stage-2/electric-vehicle-projections-2024.pdf

- BBVA Research. (2023). The rise of China’s EV sector and its implications for the world. https://www.bbvaresearch.com/wp-content/uploads/2023/04/The_rise_of_China_s_EV_sector_and_its_implications_for_the_world_WB.pdf

- Center for Automotive Research. (2024). White Paper – Affordability: The Twenty-Five Thousand Dollar Electric Vehicle. https://www.cargroup.org/wp-content/uploads/2024/08/CAR-Affordability-the-25k-EV-Aug-2024-FINAL.pdf

- DergiPark. (2025). Integrated Emission and Cost Analysis of Battery-Electric Vehicles up to 2035. https://dergipark.org.tr/en/download/article-file/5102865

- Deutsches Zentrum für Luft- und Raumfahrt. (2014). Autonomous Driving. https://elib.dlr.de/110337/1/ifmo_2016_Autonomous_Driving_2035_en.pdf

- Klier, T. H., & Rubenstein, J. M. (2022). North America’s rapidly growing electric vehicle market: Implications for the geography of automotive production. Economic Perspectives, (5). https://doi.org/10.21033/ep-2022-5

- Kolpakov. (2020). Implications of Market Penetration of Electric and Autonomous Vehicles for Florida State Transportation Revenue. Athens Journal of Technology & Engineering, 7(4). https://www.athensjournals.gr/technology/2020-7-4-4-Kolpakov.pdf

- Lagos, D. C., Mancilla Vargas, R. A., Reinecke, C., & Leal, P. (2023). Electric Vehicles and the Use of Demand Projection Models: A Systematic Mapping of Studies. Ingeniería e Investigación, 43(e99251). https://doi.org/10.15446/ing.investig.99251

- MDPI. (2024). Environmental Aspects and Recycling of Solid-State Batteries: A Comprehensive Review. https://www.mdpi.com/2313-0105/10/7/255

- MDPI. (2025). Bridging Policy, Infrastructure, and Innovation: A Causal and Predictive Analysis of Electric Vehicle Integration Across Africa, China, and the EU. https://www.mdpi.com/2071-1050/17/12/5449

- Peplow, M. (2025). Electric Vehicle Market Slowly Edges Toward Solid-State Batteries. Engineering, 45, 3-5. https://doi.org/10.1016/j.eng.2024.12.004