The automotive landscape has reached a definitive turning point as we close out 2025. What was once a niche market dominated by a single player has blossomed into a complex, multi-polar industry where technology, geopolitics, and consumer preference collide. This year has been characterized by massive shifts in market leadership, the rise of tech-driven newcomers, and a fundamental restructuring of how we perceive the future of mobility. As of late December 2025, the data provides a clear picture of which brands are accelerating and which are struggling to maintain their momentum in an increasingly crowded electric vehicle (EV) sector.

- The Historic Shift: BYD Dethrones Tesla

- The European Renaissance: Legacy Brands Find Their Footing

- The American Landscape: GM and Ford’s Strategic Pivot

- The Rise of the Tech Giants: Xiaomi and the Smartphone-to-Car Pipeline

- Regional Analysis: The Growth of Emerging Markets

- Technological Advancements: Batteries and Charging

- The Role of Autonomous Driving and AI

- Economic Headwinds and Policy Changes

- Luxury vs. Mass Market: The Two-Tiered Growth

- Future Outlook: What to Expect in 2026

- Conclusion

The Historic Shift: BYD Dethrones Tesla

For years, the industry watched the gap between the American pioneer Tesla and the Chinese powerhouse BYD narrow. In 2025, that gap did not just close; it reversed. By the end of November, BYD had recorded over 2.07 million electric vehicle sales globally, a figure that includes both battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs). This performance has firmly established the Shenzhen-based company as the global volume leader.

Tesla, meanwhile, faced a challenging year. Projections for Tesla’s total 2025 deliveries hover around 1.65 million units, representing a year-over-year decline of approximately 7.7 percent. This marks the second consecutive year of delivery struggles for the company. While the Tesla Model Y remains the best-selling individual electric model in many Western markets, the brand’s overall market share has been eroded by a lack of new model refreshes and intense competition in the entry-level and luxury segments alike.

Analysts point to several factors for this shift. BYD’s aggressive pricing strategy, vertical integration of battery manufacturing, and rapid model iteration have allowed it to capture the mass market in Asia, South America, and increasingly, Europe. Tesla’s focus on autonomous driving software and the upcoming 2026 “Cybercab” has diverted attention from its current aging lineup, leaving a vacuum that rivals have been eager to fill.

The European Renaissance: Legacy Brands Find Their Footing

While Chinese manufacturers have dominated the volume discussion, the traditional European giants have shown remarkable resilience in 2025. The Volkswagen Group has consolidated its position as a leader in the European BEV market, with its ID series finally gaining the software stability and consumer trust it lacked in earlier iterations.

Volkswagen’s performance in the first half of 2025 was particularly strong, with a 34 percent surge in registrations across the continent. Brands under the VW umbrella, such as Skoda and Audi, have also seen significant gains. The Skoda Enyaq and the new Elroq have become staples in the mid-range SUV segment, while the Audi Q4 e-tron continues to attract premium buyers looking for a familiar luxury experience without the quirks often associated with tech-first startups.

BMW has emerged as a standout performer among luxury manufacturers. The BMW i4 and iX1 have seen double-digit growth, proving that a “power of choice” strategy (offering petrol, hybrid, and electric versions of the same chassis) resonates with consumers who are not yet ready for radical design shifts. BMW’s commitment to high-performance electric sedans has allowed it to poach customers from Tesla’s Model 3 and Model S segments.

The American Landscape: GM and Ford’s Strategic Pivot

In the United States, the EV story of 2025 is one of regional specialization and the impact of shifting government policy. The expiration of certain federal tax credits in September 2025 led to a massive sales pull-forward in the third quarter, followed by a cooling period in the final months of the year.

General Motors has finally seen its “Ultium” platform investments pay off. The Chevrolet Equinox EV has become a breakout success, ranking among the top three best-selling EVs in the U.S. through the middle of the year. By offering a capable electric SUV at a price point that rivals traditional internal combustion engine vehicles, GM has successfully tapped into the mainstream buyer market.

Ford has taken a different approach, focusing heavily on its most iconic nameplates. While the F-150 Lightning remains a niche product for professional and enthusiast buyers, the Mustang Mach-E continues to be a strong contributor to Ford’s EV portfolio. Ford’s decision to adopt the North American Charging Standard (NACS) has also improved consumer confidence, as owners now have access to a significantly wider network of high-speed chargers.

The Rise of the Tech Giants: Xiaomi and the Smartphone-to-Car Pipeline

Perhaps the most disruptive trend of 2025 has been the entry of consumer electronics companies into the automotive space. Xiaomi, known primarily for its smartphones and smart home devices, has achieved what many thought impossible: a profitable EV business within its first two years of operation.

The Xiaomi SU7 sedan and the YU7 SUV have seen explosive demand in China. Xiaomi delivered over 361,000 vehicles in the first eleven months of 2025, reaching its 500,000th production milestone well ahead of schedule. The company’s ability to integrate its car software into its existing ecosystem of devices has created a “locked-in” effect for millions of users, a strategy that legacy carmakers are struggling to replicate.

Xiaomi’s success highlights a broader shift in consumer expectations. Today’s buyers are increasingly prioritizing software, connectivity, and artificial intelligence over traditional automotive metrics like horsepower or handling. This “software-defined vehicle” trend is forcing every brand to reinvest in digital infrastructure or face obsolescence.

Regional Analysis: The Growth of Emerging Markets

While China, Europe, and North America remain the primary engines of EV sales, 2025 has seen surprising growth in emerging markets. Countries like India, Thailand, and Brazil are experiencing an acceleration in EV adoption, albeit from a lower baseline.

In India, policy support for local manufacturing has encouraged both domestic brands like Tata Motors and international players like BYD to expand their footprints. The shift is driven primarily by small cars and two-wheelers, which are more suited to the urban environment and charging infrastructure of the region.

In Southeast Asia, Thailand has become a regional hub for EV production, attracting significant investment from Chinese manufacturers looking to bypass tariffs in Western markets. This regionalization of supply chains is a key trend to watch as we move into 2026, as it provides a buffer against global trade tensions.

Technological Advancements: Batteries and Charging

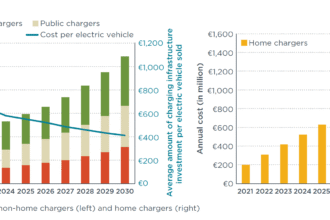

The sales growth seen in 2025 would not have been possible without significant breakthroughs in battery technology. The industry has moved toward more stable and energy-dense chemistries, reducing the “range anxiety” that has long been a barrier to entry for many consumers.

Solid-state battery research reached several key milestones this year, with pilot production lines from companies like Toyota and Samsung SDI providing a glimpse into a future with 1,000-kilometer ranges and five-minute charging times. Meanwhile, the standard for high-speed charging has shifted toward 800-volt architectures, which are now becoming common in mid-range vehicles from Hyundai, Kia, and various Chinese brands.

Charging infrastructure has also seen a massive expansion. Global investments in public charging stations have doubled compared to 2023 levels, with a focus on “ultra-fast” chargers along major transit corridors. This expansion is critical for the next wave of EV adoption, which will involve apartment dwellers and long-distance travelers who cannot rely on home charging.

The Role of Autonomous Driving and AI

As we analyze sales growth by brand, we cannot ignore the influence of autonomous vehicle (AV) technology. While full “Level 5” autonomy remains elusive, “Level 2+” and “Level 3” systems have become a major selling point in 2025.

Tesla continues to market its Full Self-Driving (FSD) suite as a primary differentiator, but it is no longer the only player in the room. Chinese brands like Xpeng and Huawei-backed AITO are deploying advanced driver-assistance systems that perform exceptionally well in complex urban environments. The integration of generative AI into vehicle infotainment systems has also become a standard feature, allowing for more natural voice interactions and personalized driving experiences.

Economic Headwinds and Policy Changes

The year 2025 has not been without its challenges. The global automotive industry has had to navigate a complex web of tariffs and trade restrictions. The European Union and the United States have both implemented measures to protect their domestic industries from low-cost imports, particularly from China.

These trade barriers have led to a “localization” of manufacturing. BYD, for instance, has accelerated its plans for factories in Hungary, Brazil, and Mexico to ensure its vehicles remain competitive in those markets despite high import duties. For the consumer, this has resulted in a more varied price landscape, with some regions seeing price drops due to local competition and others seeing increases due to tariff impacts.

The withdrawal of the $7,500 tax credit in the U.S. has also tested the market’s organic demand. While sales slowed initially, the market has shown a degree of maturity; consumers are increasingly choosing EVs for their lower operating costs and superior performance rather than just the financial incentives.

Luxury vs. Mass Market: The Two-Tiered Growth

Growth in 2025 has followed two distinct paths. In the luxury segment, brands like Porsche, Lucid, and Mercedes-Benz are catering to a high-income demographic that values exclusivity and cutting-edge tech. The Porsche Taycan and the Lucid Air continue to set benchmarks for performance, while the Mercedes EQS and EQE cater to those seeking ultimate comfort.

In the mass market, the focus is on affordability and utility. The success of the Renault 5 in Europe and the Chevrolet Equinox in the U.S. shows that there is massive untapped demand for electric vehicles that cost under $35,000. Brands that can master the low-margin, high-volume segment are the ones that will define the next decade of the automotive industry.

Future Outlook: What to Expect in 2026

Looking ahead to 2026, the momentum of the EV market appears unstoppable, despite the cyclical nature of the global economy. We expect to see:

- Further Consolidation: Smaller EV startups may struggle to survive as the “Big Three” regions (China, EU, USA) tighten their grip on the market.

- The Robotaxi Revolution: With Tesla’s Cybercab launch scheduled for April 2026, the focus will shift from vehicle ownership to “mobility as a service.”

- Battery Innovations: The first commercial applications of semi-solid-state batteries will likely hit the market, offering a middle ground between current tech and the fully solid-state future.

- Grid Integration: As more EVs hit the road, vehicle-to-grid (V2G) technology will become a vital part of renewable energy management, allowing car batteries to support the electrical grid during peak demand.

Conclusion

The 2025 EV sales data reveals a world in transition. The era of Tesla’s undisputed dominance has evolved into a vibrant, competitive arena where Chinese innovation, European heritage, and American engineering are all vying for a piece of the future. While the leaderboard has changed, the ultimate winner is the consumer, who now has access to a wider range of cleaner, more efficient, and more advanced transportation options than ever before.

For more detailed information and daily updates on the EV market, you can visit industry leaders and data providers:

- EV Volumes – Global Sales Data

- BloombergNEF – Energy and Transport Finance

- International Energy Agency (IEA) – Global EV Outlook

- Electrek – Daily EV News

https://kentshield.online/category/news/ev-market-growth-reports