The global automotive landscape is witnessing a seismic shift as we close out 2025. For years, the industry pointed toward the year 2025 as the critical juncture where electric vehicles would finally achieve price parity with internal combustion engine counterparts. As of late December 2025, that vision is no longer a forecast but a documented reality. The cost of energy storage, which represents the single most expensive component of an electric car, has reached a historic low, fundamentally altering the economics of transportation, renewable energy integration, and global commodity markets.

- Current State of EV Battery Costs in December 2025

- Regional Price Disparities: The Geopolitics of Energy

- The Lithium and Raw Material Market Update

- Technological Innovations Driving Down Costs

- The Rise of Sodium Ion Batteries

- Solid State Batteries: The 2027 Commercialization Horizon

- Stationary Energy Storage: The Cheapest Segment

- The Circular Economy: Battery Recycling in 2025

- Government Policy and Its Impact on Pricing

- Strategic Forecast: Battery Costs Through 2030

- Investment Implications in the Battery Sector

- Summary of Key Battery Cost Metrics as of December 2025

- Final Thoughts on the Future of Mobility

Current State of EV Battery Costs in December 2025

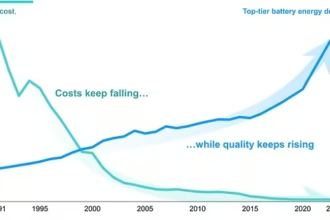

The most recent data from BloombergNEF and other leading energy researchers confirms that the volume weighted average price for lithium ion battery packs has fallen to 108 dollars per kilowatt hour in 2025. This represents an eight percent decline from the previous year, continuing a decade long trend of cost reduction that has seen prices plunge by over ninety percent since 2010.

For the second consecutive year, battery electric vehicle packs specifically have broken the psychological and economic barrier of 100 dollars per kilowatt hour, averaging 99 dollars per kilowatt hour globally. This milestone is significant because 100 dollars is widely considered the threshold at which manufacturers can produce and sell mass market electric cars at the same price and margin as gasoline vehicles without relying on government subsidies.

While the average is 108 dollars, the market is highly fragmented based on chemistry and region. Lithium Iron Phosphate batteries, known as LFP, have reached an average of 81 dollars per kilowatt hour. In contrast, high performance Nickel Manganese Cobalt packs, which offer greater energy density for long range premium vehicles, are currently averaging 128 dollars per kilowatt hour.

Regional Price Disparities: The Geopolitics of Energy

One of the most striking features of the 2025 battery market is the massive price gap between different geographical regions. While the global average is dropping, the price you pay for a battery depends heavily on where it is manufactured.

China: The Global Price Leader

China continues to dominate the cost curve. In December 2025, the average battery pack price in China is approximately 84 dollars per kilowatt hour. This efficiency is driven by massive overcapacity in cell manufacturing, a highly integrated local supply chain, and the rapid adoption of LFP chemistry. In China, electric vehicle price parity was achieved in almost every vehicle segment early this year, leading to a market where new energy vehicles now account for over half of all new car sales.

North America and Europe: The Premium Markets

Prices in North America and Europe remain significantly higher than in Asia. In the United States, average pack prices are roughly 144 dollars per kilowatt hour, representing a forty four percent premium over Chinese prices. Europe sits slightly lower at 123 dollars per kilowatt hour.

These higher costs are attributed to several factors. First, the reliance on imported materials and components adds logistical costs. Second, higher labor and energy costs in Western gigafactories contribute to a higher baseline production cost. Finally, trade policies and tariffs, particularly the recent updates to the Inflation Reduction Act in the US and new carbon border adjustment mechanisms in the EU, have created a protected but more expensive domestic market.

The Lithium and Raw Material Market Update

The price of raw materials remains the primary driver of battery costs, accounting for roughly sixty percent of the total price of a cell. As of December 30, 2025, the lithium market has stabilized after years of extreme volatility.

Lithium Carbonate Prices

Daily market reports from Mysteel and Fastmarkets show that battery grade lithium carbonate is currently trading between 11,000 and 15,000 dollars per tonne. While this is a slight increase from the lows seen in mid 2024, it is a fraction of the record highs of 80,000 dollars per tonne seen in 2022. The current price level is considered a healthy mid cycle range that allows miners to remain profitable while keeping battery production affordable.

Cobalt and Nickel Dynamics

Cobalt prices have faced upward pressure recently due to new export quotas introduced by the Democratic Republic of Congo in late 2025. However, the impact on the overall battery market has been muted because many manufacturers have successfully shifted toward cobalt free LFP chemistries or high nickel cathodes that require significantly less cobalt than older designs. Nickel prices have remained relatively stable due to consistent supply from Indonesia, despite occasional concerns regarding environmental regulations in mining operations.

Technological Innovations Driving Down Costs

Beyond raw material prices, engineering breakthroughs are playing a vital role in reaching new cost floors. The industry is moving beyond simple chemistry changes to holistic manufacturing improvements.

Cell to Pack and Cell to Chassis Design

Traditional battery packs are made of modules, which are in turn made of cells. This multi layered approach adds weight and cost. In 2025, we are seeing the widespread adoption of Cell to Pack and even Cell to Chassis designs. By eliminating the module layer, manufacturers can fit more energy into the same space while reducing the number of parts and the complexity of the assembly process. This innovation alone has contributed to a five to seven percent reduction in pack level costs this year.

Dry Electrode Manufacturing

One of the most anticipated manufacturing shifts is the move toward dry electrode coating. Traditional battery manufacturing requires a massive amount of energy and floor space for drying ovens to remove solvents from the electrode slurry. Dry coating eliminates these ovens, reducing energy consumption by up to forty percent and capital expenditure for new factories by thirty percent. While still in the scaling phase, several major players have integrated dry coating into their 2025 production lines.

The Rise of Sodium Ion Batteries

In 2025, sodium ion technology has moved from the laboratory to the road. Sodium is abundant and incredibly cheap compared to lithium. While sodium ion batteries have lower energy density than lithium ion counterparts, they are ideal for small city cars and stationary energy storage. Current estimates suggest that sodium ion cells can be produced at twenty to thirty percent lower cost than LFP cells. This year, we have seen the first mass production city cars equipped with sodium ion batteries hitting the market in Asia and Southeast Asia, further driving down the entry price for electric mobility.

Solid State Batteries: The 2027 Commercialization Horizon

While liquid electrolyte lithium ion batteries are the current standard, the industry is hyper focused on the solid state revolution. Solid state batteries promise to double energy density and eliminate fire risks, but they remain expensive to manufacture.

As of late 2025, several pilot lines are operational. Companies like Factorial Energy, which recently announced plans for an IPO in mid 2026, and QuantumScape have successfully delivered high capacity prototype cells to automotive partners for vehicle testing. Toyota and Volkswagen have both indicated that they expect the first limited production luxury vehicles with solid state batteries to appear in showrooms by late 2026 or 2027.

The current cost of these prototype solid state cells is estimated to be over 300 dollars per kilowatt hour, but analysts predict that as manufacturing scales and vacuum deposition techniques improve, these costs will fall rapidly toward the 150 dollar mark by 2030.

Stationary Energy Storage: The Cheapest Segment

An often overlooked part of the battery story is stationary energy storage systems, or BESS. These systems, used to store solar and wind power for the grid, don’t require the extreme energy density or fast charging capabilities of car batteries. As a result, they can use cheaper, older, or lower grade cells.

In 2025, the price for stationary storage packs fell a staggering forty five percent to an average of 70 dollars per kilowatt hour. This collapse in pricing is making the combination of solar plus storage cheaper than coal or natural gas in almost every major power market globally.

The Circular Economy: Battery Recycling in 2025

Sustainability is no longer just a marketing term but a cost saving necessity. In 2025, the battery recycling industry has reached a level of maturity where it is becoming a significant source of raw materials.

Recycling facilities can now recover over ninety five percent of the lithium, cobalt, and nickel from old batteries. Urban mining, the process of extracting materials from used electronics and vehicles, is projected to provide up to fifteen percent of the total battery material demand by 2030. This secondary supply helps dampen price spikes in the primary mining market and provides a more stable cost structure for manufacturers.

Government Policy and Its Impact on Pricing

The cost of a battery is not just determined by the factory but also by the capitol. In 2025, the landscape of subsidies and tariffs is more complex than ever.

The United States Inflation Reduction Act continues to provide significant tax credits for batteries manufactured in North America with friendly sourced minerals. This has spurred a massive wave of domestic gigafactory construction, though the immediate effect has been higher prices for consumers due to the cost of domestic production versus cheap imports.

In Europe, the introduction of the Battery Passport and strict carbon footprint regulations has forced manufacturers to invest in greener, more expensive production methods. While this increases the upfront cost of the battery, it ensures long term market access and aligns with the region’s climate goals.

Strategic Forecast: Battery Costs Through 2030

Looking ahead, the trajectory for battery costs remains downward, though the pace of decline may slow as the industry matures.

2026 to 2027 Predictions

Analysts expect a slight stabilization in 2026 as manufacturers digest the rapid capacity expansions of the previous years. Prices may stay relatively flat or drop by only two to three percent. However, as next generation technologies like silicon anodes and initial solid state offerings enter the market, we will see a wider range of price points.

2030 Outlook

By 2030, BloombergNEF predicts that the average battery pack price will reach 69 dollars per kilowatt hour. At this price point, electric vehicles will not only be cheaper to buy than gasoline cars but will also offer significantly higher margins for manufacturers. The total market value for EV batteries is expected to grow to nearly 500 billion dollars by 2030, driven by a compound annual growth rate of over fourteen percent.

Investment Implications in the Battery Sector

For investors, the 2025 battery market presents a diverse set of opportunities. The focus has shifted from pure play lithium miners to companies involved in advanced manufacturing and recycling.

Major players like CATL, BYD, and LG Energy Solution continue to lead in volume, but smaller specialized firms are gaining ground in high growth niches. Companies focusing on ultra fast charging batteries and sodium ion technology are seeing significant venture capital interest. The solid state sector is particularly hot, with companies like Factorial Energy and Solid Power being closely watched as they move toward public listings and commercialization milestones.

Summary of Key Battery Cost Metrics as of December 2025

The following data points summarize the current state of the market:

Average Global Battery Pack Price: 108 dollars per kilowatt hour.

Average Price for BEV Packs: 99 dollars per kilowatt hour.

Average Price in China: 84 dollars per kilowatt hour.

Average Price in the United States: 144 dollars per kilowatt hour.

Average Price for LFP Chemistry: 81 dollars per kilowatt hour.

Average Price for NMC Chemistry: 128 dollars per kilowatt hour.

Stationary Storage Pack Price: 70 dollars per kilowatt hour.

Lithium Carbonate Spot Price: 11,000 to 15,000 dollars per tonne.

Final Thoughts on the Future of Mobility

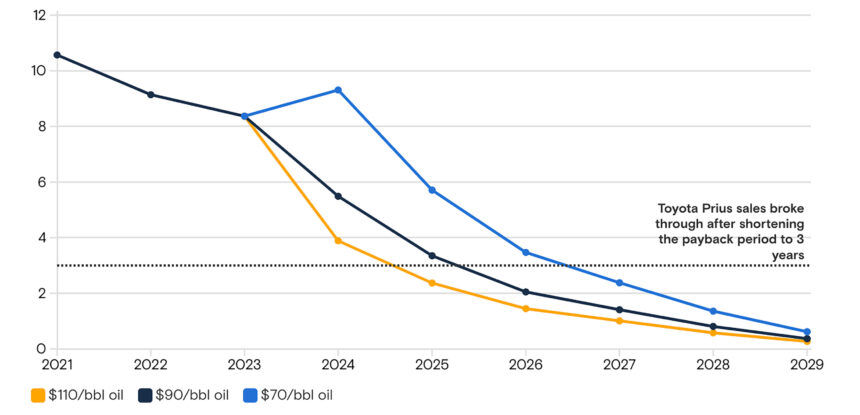

The events of 2025 have proven that the transition to electric mobility is no longer a question of “if” or “when,” but a question of “how fast.” With battery prices consistently breaking the 100 dollar threshold, the economic barriers to electrification have largely dissolved. The challenges that remain are primarily logistical: building out charging infrastructure, securing stable mineral supply chains, and managing the geopolitical tensions of a global energy shift.

As we look toward 2026, the focus will likely shift toward the next frontier of energy density and the integration of batteries into the wider smart grid. The battery is no longer just a car part; it is the fundamental unit of the new energy economy.