The year 2025 has officially drawn to a close, marking one of the most significant periods in the history of the automotive industry. This year, the transition toward electrified mobility moved beyond the early adopter phase and into a state of mass-market dominance in several major economies. As of late December 2025, the data suggests that the global automotive landscape has been fundamentally reshaped by aggressive competition, technological breakthroughs, and shifting geopolitical trade policies.

- Executive Summary of the 2025 EV Landscape

- The Battle for Global Supremacy: BYD versus Tesla

- China: The Undisputed Engine of Electrification

- Europe’s Resilient Growth Amidst Economic Headwinds

- The United States Market: Policy Shifts and Private Sector Resilience

- Technological Frontiers: Batteries and Charging Solutions

- Emerging Powerhouses: India and Southeast Asia

- Economic Analysis: Insurance, Financing, and Resale Values

- Detailed 2025 Regional EV Market Share Table

- Sources and Further Reading

- The Road Ahead: Projections for 2026 and Beyond

Executive Summary of the 2025 EV Landscape

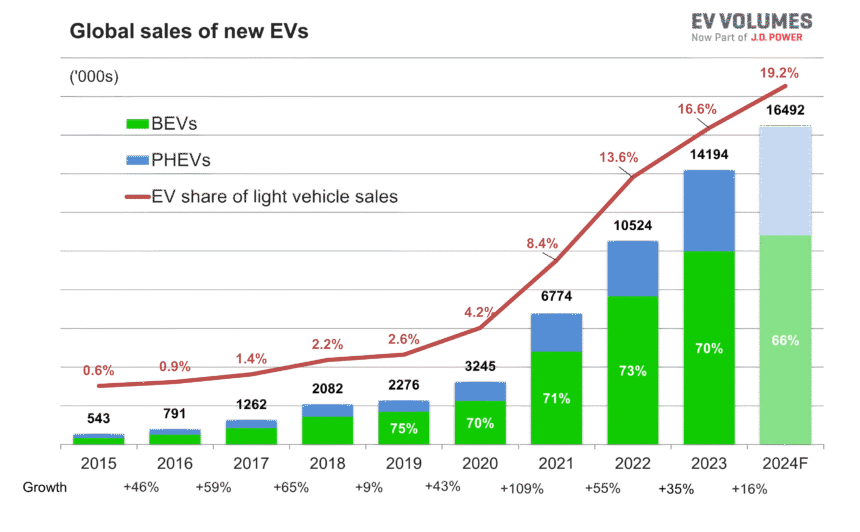

By the end of 2025, global plug-in vehicle sales, which include both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), reached an estimated 22.1 million units. This represents a 24 percent share of the total global light-vehicle market. The growth has been driven by a combination of resilient demand in China, a recovery in European manufacturing, and the emergence of highly competitive affordable models in Southeast Asia and India.

While the total volume of sales has increased, the internal dynamics of the market have shifted. For the first time, we have witnessed a change in the global leadership for pure electric vehicle sales. Furthermore, the industry has navigated a complex landscape of fluctuating subsidies, new trade tariffs, and the rapid expansion of charging infrastructure.

The Battle for Global Supremacy: BYD versus Tesla

One of the most talked about stories of the year is the official crowning of a new global leader in pure battery electric vehicle sales. As of December 30, 2025, Chinese manufacturer BYD has effectively surpassed Tesla in annual BEV deliveries. This transition marks a historic moment, as Tesla had held the top spot for nearly a decade.

BYD’s Unstoppable Momentum

BYD entered December 2025 with a massive lead. By the end of November, the Shenzhen based company had already sold 2.07 million pure electric vehicles for the year. When including their plug-in hybrids, the numbers are even more staggering. BYD’s success can be attributed to its vertically integrated supply chain, which allows it to produce its own batteries and semiconductors, keeping costs significantly lower than its Western counterparts.

The company’s diverse lineup, ranging from the budget-friendly Seagull and Dolphin models to the luxury Yangwang brand, has allowed it to capture every segment of the market. In 2025, BYD also saw a massive surge in international exports, with strong sales figures in Brazil, Thailand, and several European nations despite increased tariffs.

Tesla’s Strategic Transition and Challenges

Tesla remains a dominant force, but it faced a more difficult path in 2025. Analysts from FactSet and Deutsche Bank project that Tesla will finish the year with approximately 1.65 million deliveries. This represents a year-over-year decline of about 7.7 percent compared to 2024.

Several factors contributed to this slowdown. In the United States, the sudden expiration of federal tax credits in October 2025 led to a massive pull-forward of demand in the third quarter, followed by a sharp drop in the fourth quarter. Additionally, increasing competition from legacy automakers and the aging of the Model 3 and Model Y platforms have put pressure on Tesla’s market share. However, the company continues to focus on its autonomous driving software and the upcoming production of the Cybercab, which is slated for early 2026.

China: The Undisputed Engine of Electrification

China continues to lead the world in both production and consumption of electric vehicles. In 2025, the country reached a milestone that many thought was years away: more than half of all new passenger cars sold in China are now electrified.

The 51.6 Percent Milestone

For the full year of 2025, electric vehicles accounted for 51.6 percent of all light-vehicle sales in China. This is a remarkable achievement that solidifies the country’s position as the primary laboratory for the future of transport. The domestic market has benefited from intense price competition, which has made EVs cheaper than their internal combustion engine equivalents in many categories.

Brands like Geely, NIO, and XPeng have joined BYD in dominating the domestic charts. Geely, in particular, saw its Zeekr and Galaxy brands perform exceptionally well, capturing nearly 10 percent of the global BEV market share this year.

Export Strategies and Global Expansion

Faced with a maturing domestic market, Chinese automakers have looked toward global expansion. In 2025, Chinese EV exports increased by over 30 percent compared to the previous year. To navigate the high tariffs imposed by the United States and the European Union, companies like BYD and Chery have begun investing heavily in local manufacturing plants in regions like Hungary, Turkey, and Brazil. This strategy is expected to yield results in 2026 as these facilities come online.

Europe’s Resilient Growth Amidst Economic Headwinds

The European EV market showed surprising resilience in 2025. Despite a broader economic slowdown in several Eurozone countries, EV sales are forecast to finish the year with a 26.7 percent increase, capturing a 26.2 percent market share.

Volkswagen’s Return to the Top in Europe

In a significant turnaround, the Volkswagen Group reclaimed its title as the top-selling BEV brand in Europe for 2025. After losing ground to Tesla in previous years, VW’s refreshed ID series, including the ID.4, ID.3, and the high-end ID.7, saw a major surge in registrations. The ID.7, in particular, has become a favorite in the corporate fleet market due to its impressive range and premium features.

The Impact of New Emission Targets

The growth in Europe has been partially driven by the looming 2025 CO2 emission targets set by the European Union. Automakers were forced to sell a higher percentage of zero-emission vehicles to avoid multi-billion euro fines. This led to aggressive marketing campaigns and the introduction of more affordable models, such as the Renault 5 and the Citroen e-C3, which have started to appeal to the mass market.

The United States Market: Policy Shifts and Private Sector Resilience

The U.S. electric vehicle market experienced a year of extreme volatility in 2025. While the overall trend remains positive, political shifts have created a unique set of challenges for manufacturers.

The End of the Federal EV Tax Credit

In late 2025, under new legislative directions, the $7,500 federal tax credit for electric vehicles was officially discontinued. This move had a profound impact on sales figures for the fourth quarter. Manufacturers responded by offering significant “inventory adjustments” and private financing deals to keep demand alive.

Cox Automotive reports that while the market grew in the first half of the year, the second half saw a cooling period. Overall, the EV share in the U.S. is expected to hold steady at around 10 percent for 2025, a figure that is lower than earlier optimistic projections but still represents growth in absolute volume.

Infrastructure Growth: 230,000 Connectors and Counting

One of the brightest spots in the U.S. market is the continued expansion of charging infrastructure. As of December 2025, there are approximately 230,000 public charging connectors online across the country. Interestingly, the majority of this growth in 2025 was led by the private sector rather than federal programs. Companies like Tesla (opening up the Supercharger network to other brands), EVgo, and Electrify America have accelerated their deployment of 350kW ultra-fast chargers along major highway corridors.

Technological Frontiers: Batteries and Charging Solutions

The rapid pace of technological innovation is a core reason why EV sales have remained high. In 2025, we saw several major breakthroughs in battery chemistry and charging speeds that have helped alleviate “range anxiety” for many potential buyers.

The Rise of LFP and Sodium-Ion Batteries

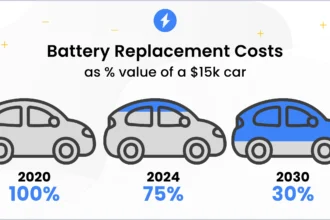

Lithium Iron Phosphate (LFP) batteries have become the standard for entry-level and mid-range vehicles in 2025. Their lower cost and superior longevity compared to traditional NCM (Nickel Cobalt Manganese) chemistries have allowed manufacturers to lower the starting price of EVs.

Furthermore, 2025 saw the first commercial scale rollout of Sodium-Ion batteries in ultra-budget urban commuters. While these batteries have lower energy density than lithium-based cells, their extremely low cost and abundance of raw materials make them a game changer for emerging markets.

Solid-State Breakthroughs in Late 2025

While still in the early stages of mass production, several manufacturers including Toyota and NIO have begun small-scale testing of semi-solid-state and all-solid-state batteries. NIO’s 150 kWh semi-solid-state pack, which allows for a range of over 1,000 kilometers on a single charge, has seen increased adoption in their premium models this year. This technology is expected to trickle down to more affordable segments by late 2027.

Emerging Powerhouses: India and Southeast Asia

Beyond the “Big Three” markets of China, Europe, and the U.S., the most exciting growth in 2025 occurred in South Asia and Southeast Asia.

India’s Electric Revolution

India’s EV market grew by over 40 percent in 2025, led primarily by two-wheelers and three-wheelers, but also seeing a significant uptick in passenger cars. Tata Motors and Mahindra have capitalized on local manufacturing incentives to provide EVs that are rugged enough for local conditions. The introduction of the Tesla “Model 2” in some global markets has also spurred local competitors to accelerate their timelines.

Southeast Asian Hubs

Thailand and Indonesia have successfully positioned themselves as regional hubs for EV manufacturing. In 2025, dozens of new assembly plants opened in these countries, many of them joint ventures between Chinese firms and local partners. This has led to a flood of affordable EVs in the ASEAN region, with adoption rates in cities like Bangkok and Jakarta hitting record highs.

Economic Analysis: Insurance, Financing, and Resale Values

The economics of owning an electric vehicle continued to evolve in 2025. While the initial purchase price of many EVs has reached parity with gasoline cars, other costs are still being optimized.

EV Insurance and Maintenance Trends

Electric vehicle insurance premiums saw a slight stabilization in 2025 as insurers gathered more data on repair costs and accident rates. While still often higher than traditional cars due to the high cost of specialized battery repairs, the gap is narrowing. On the maintenance front, the long term benefits of EVs are becoming clearer to consumers, with many 2025 models requiring significantly less frequent servicing than older ICE vehicles.

The Secondary Market and Resale Values

One of the biggest concerns for buyers in 2025 was the resale value of their vehicles. With technology moving so fast, older EVs can sometimes depreciate more quickly than expected. However, the rise of “battery health certification” programs has helped shore up the used EV market. Buyers in 2025 are now more comfortable purchasing a three-year-old EV if they have a verified report on the state of the battery pack.

Detailed 2025 Regional EV Market Share Table

The following table summarizes the market performance of the leading regions in 2025 based on the most recent end of year data.

| Region | EV Market Share (2025) | Growth vs 2024 | Top Selling Brand |

| China | 51.6% | +15% | BYD |

| Europe | 26.2% | +26% | Volkswagen Group |

| United States | 9.8% | +2% | Tesla |

| India | 7.1% | +42% | Tata Motors |

| SE Asia | 8.4% | +38% | BYD |

| Rest of World | 6.7% | +47% | Geely / BYD |

Sources and Further Reading

To stay updated with the latest daily shifts in the global EV market, the following organizations and reports provide the most comprehensive data:

- IEA Global EV Outlook 2025

- EV-Volumes Sales Database

- BloombergNEF Electric Vehicle Outlook

- Statista: Global EV Market Figures

- Counterpoint Research: Quarterly EV Tracker

The Road Ahead: Projections for 2026 and Beyond

As we look toward 2026, the momentum for electric vehicles appears unstoppable, even if the pace of growth varies by region. The industry is currently entering a “rationalization” phase. Marginal players are being consolidated or exiting the market, while the giants like BYD, Tesla, and the Volkswagen Group are doubling down on software defined vehicles and autonomous driving.

In the coming year, we expect to see even more focus on the “Second Life” of EV batteries, with large scale energy storage projects utilizing retired car batteries to stabilize national power grids. Furthermore, the expansion of NACS (North American Charging Standard) will reach its full implementation in 2026, making the charging experience much more seamless for North American drivers.

The 2025 sales figures prove that the electric vehicle is no longer a niche product or a futuristic dream. It is the current reality of the global automotive industry. Whether driven by policy, environmental concern, or simply the desire for a better driving experience, the world has chosen electricity.