As of today, December 30, 2025, the automotive industry stands at a critical juncture. The transition to electric mobility has moved beyond the early adopter phase into a period of massive industrial scaling and geopolitical maneuvering. This report provides a deep dive into the latest adoption statistics, technological breakthroughs, and market forecasts that will define the electric vehicle landscape through 2026.

- Global EV Market Overview: Breaking the 20 Million Barrier

- Regional Performance: A Tale of Three Markets

- Technological Catalysts: The Battery Revolution

- Infrastructure Expansion: Solving the Range Anxiety Puzzle

- Investment Trends and Market Dynamics

- Consumer Sentiment in 2026: What Buyers Want

- Forecast for 2026: The Road Ahead

- Live Information: Update for December 30, 2025

Global EV Market Overview: Breaking the 20 Million Barrier

The year 2025 has proved to be a historic milestone for sustainable transportation. For the first time, global sales of electric vehicles (EVs), including battery electric vehicles (BEVs) and plug-in hybrids (PHEVs), have surpassed the 20 million unit mark. This represents a significant leap from the 17.8 million units sold in 2024.

Recent data suggests that approximately 24 percent of all new passenger cars sold globally in 2025 were electric. As we move into 2026, this share is projected to climb to 25 percent, meaning one in every four new vehicles on the road worldwide will feature a plug.

Key Global Metrics at a Glance

- Total 2025 Sales Projection: 22.1 million units.

- Expected 2026 Sales Projection: 23.5 million to 24.2 million units.

- Current Global Market Share: 24 percent.

- Major Growth Drivers: Falling battery costs and stricter emissions regulations in the European Union and China.

Regional Performance: A Tale of Three Markets

The global growth in EV adoption is not uniform. The market has branched into three distinct trajectories: the hyper-accelerated growth in China, the regulatory-led steady climb in Europe, and a period of policy-driven cooling in North America.

China: The Global Powerhouse

China continues to dominate the global landscape, accounting for more than 60 percent of all EV sales worldwide. In 2025, New Energy Vehicles (NEVs) achieved a market share of over 51 percent in the country, officially outselling internal combustion engine (ICE) vehicles for the first time.

The dominance of domestic brands like BYD has reshaped the competitive environment. BYD is on track to end 2025 as the world’s largest EV seller, surpassing Tesla in total annual deliveries. The company’s ability to offer high-quality vehicles at price parity with gasoline cars has effectively removed the “green premium” for Chinese consumers.

Europe: Navigating Regulatory Pressure

In Europe, 2025 has been a year of recovery. After a slight dip in growth during 2024, the market rebounded with a 26.7 percent increase in sales. This was largely driven by manufacturers pushing new, more affordable models to meet the stringent CO2 fleet targets set for 2025.

Norway remains the global outlier, with a BEV market share exceeding 90 percent. Meanwhile, Germany and the United Kingdom are engaged in a close race for the highest total volume of sales in the region. The UK has seen its EV market share hit 22.7 percent as of November 2025, supported by the Zero Emission Vehicle mandate.

North America: The Policy Setback

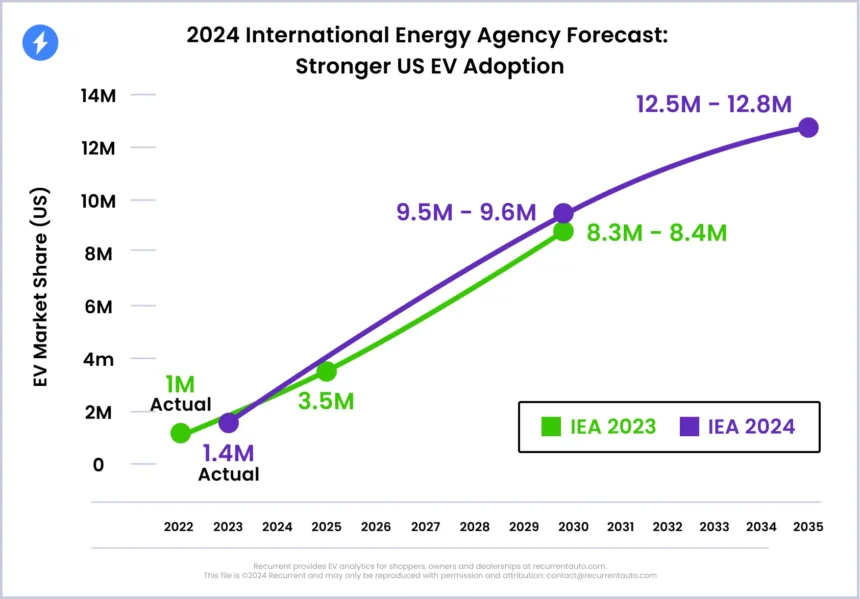

In contrast to the global trend, the United States has experienced a plateau. Adoption rates have hovered around 10 percent for much of 2025. The termination of federal tax credits under recent legislative changes, such as the One Big Beautiful Bill Act, has created a temporary cooling effect.

Industry analysts expect the US market share to dip slightly to around 8.5 percent in 2026 before recovering in 2027. However, the commercial sector remains a bright spot, with electric delivery vans and light trucks seeing steady demand from corporate fleets looking to meet long-term sustainability goals.

Technological Catalysts: The Battery Revolution

The cost and capability of batteries remain the primary factors influencing EV adoption. In 2025, the industry witnessed a massive expansion in manufacturing capacity, with global battery demand surpassing 1 TWh.

The Rise of Lithium Iron Phosphate (LFP)

LFP chemistry has become the preferred choice for mass-market vehicles due to its lower cost and longer cycle life compared to nickel-based chemistries. In 2025, nearly 50 percent of all new EVs utilized LFP batteries. This shift has been instrumental in bringing entry-level EV prices down to the $20,000 to $25,000 range in competitive markets.

Solid-State Battery Progress

While mass-market solid-state batteries are still on the horizon, 2025 saw the first commercial pilot programs. China has announced a combined manufacturing capacity of 700 GWh for semi-solid and solid-state battery technologies currently under construction or in early operation. These batteries promise to double the energy density of current cells, potentially offering ranges exceeding 600 miles (1,000 km) on a single charge by 2026 and 2027.

Shutterstock

Infrastructure Expansion: Solving the Range Anxiety Puzzle

The growth of the charging network is finally beginning to keep pace with vehicle sales. By the end of 2025, the global public charging infrastructure saw an 18 to 22 percent increase in total installations.

Ultra-Rapid Charging is the New Standard

The focus has shifted from “slow” AC chargers to “ultra-rapid” DC chargers (150kW and above). In the UK alone, over 3,000 rapid or ultra-rapid chargers were added to the public network in 2025. This infrastructure allows for “gas station-like” experiences, where a vehicle can gain 200 miles of range in less than 15 minutes.

The Integration of Smart Grids

As millions of new EVs hit the road, the relationship between vehicles and the energy grid has become more sophisticated. Vehicle-to-Grid (V2G) technology is transitioning from pilot projects to standard features in several 2026 models. This allows EVs to act as mobile batteries, supporting the grid during peak demand and providing homeowners with emergency backup power.

Investment Trends and Market Dynamics

The financial landscape of the automotive industry is undergoing a radical transformation. Traditional manufacturers are facing significant pressure to restructure their operations as the “Total Cost of Ownership” (TCO) for EVs becomes undeniably superior to gasoline vehicles.

The Emerging Market Surge

While developed economies deal with policy fluctuations, emerging markets are seeing record growth. Countries like Thailand, Vietnam, Brazil, and India are emerging as the next frontiers for electrification. In India, the entry of major domestic players like Maruti Suzuki into the EV space in 2026 is expected to be a tipping point for the subcontinent.

Geopolitical Shifts and the “Mexico Strategy”

Trade tensions have led to a strategic repositioning of the supply chain. To navigate high tariffs in North America, Chinese manufacturers have significantly increased their investments in Mexico. Export data from late 2025 shows a 2,367 percent year-over-year surge in Chinese EV shipments to Mexico, which serves as a strategic hub for Latin American and potentially future North American distribution.

Consumer Sentiment in 2026: What Buyers Want

Despite the technological progress, consumer concerns persist. A recent 2025 study by S&P Global highlighted that while optimism is growing, 60 percent of consumers still view initial purchase costs as the primary barrier.

However, secondary market dynamics are changing. The availability of high-quality used EVs is beginning to democratize access. Used EV prices have stabilized, making them an attractive option for budget-conscious buyers who were previously priced out of the new car market.

Feature Priorities

- High-Speed Charging: Ranked as the top priority for 56 percent of buyers.

- Integrated Software: The demand for advanced driver assistance systems (ADAS) and over-the-air updates is now a standard expectation.

- Sustainable Materials: A growing segment of the market specifically looks for vegan interiors and recycled components.

Forecast for 2026: The Road Ahead

Looking forward to 2026, several key trends will define the year:

- Convergence of Prices: We expect several more “budget” EV models to launch in Europe and North America, targeting the sub-$30,000 price point.

- Battery Surplus: A projected oversupply of battery cells may lead to a further 10 to 15 percent drop in battery pack prices, benefiting manufacturers’ margins.

- Commercial Fleet Tipping Point: Logistics companies will likely accelerate their transition as urban “zero-emission zones” become more common in major global cities.

- Hydrogen Integration: While passenger cars remain battery-focused, 2026 will see increased adoption of hydrogen fuel cells in heavy-duty long-haul trucking.

Live Information: Update for December 30, 2025

Recent reports from industry trackers like EV Volumes and BloombergNEF indicate that the final quarter of 2025 has seen a massive “rush” in sales across Europe and China as consumers look to secure existing incentives before they are adjusted for the 2026 fiscal year. In China, December deliveries are expected to break all previous monthly records, cementing the country’s lead in the global race.