The automotive landscape is undergoing its most significant transformation since the invention of the assembly line. As we close out December 2025, the global transition toward electric mobility is no longer just a trend: it is a high-stakes regulatory battleground. Governments across North America, Europe, and Asia have recently enacted sweeping laws that redefine how vehicles are manufactured, sold, and recycled. These updates have sent ripples through the financial markets, impacting everything from tech investments to insurance premiums.

- The United States: A Dramatic Policy Pivot in Late 2025

- China: Setting the Global Benchmark for Energy Efficiency

- The European Union: The Circular Economy and Battery Passports

- The United Kingdom: The ZEV Mandate and the 2035 Horizon

- Infrastructure and Grid Stability: The NACS Revolution

- Supply Chain Transparency and ESG Compliance

- Corporate Fleet Mandates: The Hidden Driver of Demand

- Insurance and Risk Management in the EV Era

- Conclusion: Preparing for 2026 and Beyond

For investors, manufacturers, and consumers, staying informed is critical. The regulations announced in late 2025 are not merely suggestions: they are binding mandates with heavy penalties for non-compliance. This comprehensive guide explores the latest legislative shifts and what they mean for the future of transportation.

The United States: A Dramatic Policy Pivot in Late 2025

The most shocking development of the year occurred in July 2025 with the signing of the One Big Beautiful Bill Act. This legislation significantly altered the trajectory set by previous climate-focused policies. The most immediate impact was the termination of the federal clean vehicle income tax credits as of September 30, 2025.

Under this new regime, the $7,500 credit for new electric vehicles and the $4,000 credit for used models are now effectively defunct for the vast majority of the market. This move has forced a radical restructuring of the domestic automotive market. Manufacturers who relied on these subsidies to lower the barrier to entry for consumers are now pivoting toward aggressive internal cost-cutting measures.

However, a small window of eligibility remains for specific niche manufacturers who have not yet reached significant sales volumes. This has created a temporary competitive advantage for emerging startups like Rivian and Lucid, while established giants like Tesla and Ford must now compete on price and performance without federal assistance. Furthermore, the Department of Transportation and the Environmental Protection Agency have proposed a rescission of the 2009 endangerment finding. If finalized, this would remove the legal foundation for federal greenhouse gas standards for light-duty vehicles.

For live updates on U.S. federal automotive policy and current rebate availability at the state level, you can visit the Alternative Fuels Data Center or the official IRS page for Clean Vehicle Credits.

China: Setting the Global Benchmark for Energy Efficiency

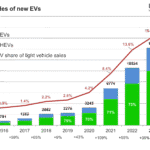

While the United States focuses on deregulation, China is moving in the opposite direction by tightening efficiency requirements. As of December 30, 2025, the Chinese Ministry of Industry and Information Technology is preparing for the January 1, 2026, implementation of the world’s first mandatory energy consumption limits for electric passenger vehicles.

This new national standard, known as GB 36980.1-2025, replaces previous voluntary guidelines with strict legal force. For a standard two-tonne electric vehicle, the maximum allowed electricity consumption is now set at 15.1 kilowatt-hours per 100 kilometers. This represents an 11% tightening of efficiency requirements. Manufacturers who fail to meet these targets will see their vehicles removed from the purchase tax exemption catalog, effectively raising the price for consumers overnight.

China is also introducing unique safety mandates. A recent bill mandates that by 2027, all electric vehicles must have mechanical emergency releases for both internal and external door handles. This is a direct response to safety concerns regarding electronically controlled recessed handles that may fail during a power outage or accident.

To track daily developments in the Chinese NEV market, the China Association of Automobile Manufacturers (CAAM) provides frequent data releases.

The European Union: The Circular Economy and Battery Passports

The European Union continues to lead the world in sustainability through the implementation of the New Batteries Regulation, which reached a major milestone in August 2025. This regulation treats batteries not just as components, but as critical assets within a circular economy.

A central pillar of this law is the “Digital Battery Passport.” By 2027, every electric vehicle battery sold in the EU over 2 kWh must have a digital twin that records its entire life cycle: from the sourcing of raw materials like lithium and cobalt to its current state of health and recycled content. Starting in 2025, manufacturers are already required to disclose the carbon footprint of their production processes.

European regulators have also updated the CO2 emission targets for the 2025 to 2029 period. The target for new passenger cars is now 93.6 grams of CO2 per kilometer. To incentivize compliance, the EU has introduced a “ZLEV” (Zero and Low-Emission Vehicle) crediting system. If a manufacturer’s share of zero-emission vehicles exceeds 25%, their overall CO2 target is alleviated. Conversely, those falling short face steep fines.

Detailed information on European climate laws and automotive standards can be found on the European Commission’s Climate Action portal.

The United Kingdom: The ZEV Mandate and the 2035 Horizon

In the United Kingdom, the Zero Emission Vehicle (ZEV) Mandate is the primary driver of change. For the year 2025, the government requires that 28% of all new car sales from each manufacturer be zero-emission. This target will rise incrementally until it reaches 80% in 2030 and 100% in 2035.

The UK system operates on a certificate-based model. Manufacturers receive allowances for their sales: those who exceed their targets can sell excess certificates to those who fall behind. Failure to comply or purchase enough certificates results in a heavy fine of £15,000 per non-compliant vehicle. This has created a new secondary market for emissions trading among major automotive groups.

Furthermore, the UK government is exploring a “pay-per-mile” tax system to replace the lost revenue from fuel duties as the population moves away from petrol and diesel. While not yet fully implemented, the announcement has prompted a shift in consumer sentiment and long-term financial planning for fleet operators.

For the latest on UK automotive legislation, the Official GOV.UK portal for the ZEV Mandate is the definitive source.

Infrastructure and Grid Stability: The NACS Revolution

A major regulatory hurdle for electric vehicles has been the lack of a unified charging standard. In North America, the transition toward the North American Charging Standard (NACS) has been largely finalized in late 2025. Governments are now mandating that all publicly funded charging stations must include NACS connectors to ensure interoperability.

Grid stability has also become a focal point of new regulations. In many jurisdictions, “Smart Charging” is now a requirement for new home charger installations. These devices must be capable of communicating with the utility provider to balance loads during peak hours. Some regions in California and the EU are even experimenting with “Vehicle-to-Grid” (V2G) mandates, where EVs can act as distributed energy storage to support the power grid during emergencies.

The investment required for this infrastructure is immense. Governments are shifting from subsidizing the vehicles themselves to subsidizing the “refueling” network. For live data on charging infrastructure growth, PlugShare and BloombergNEF offer real-time insights.

Supply Chain Transparency and ESG Compliance

The “green” label on electric vehicles is being scrutinized more than ever. New regulations in 2025 focus on the ethics of the supply chain. The EU’s Due Diligence Directive and similar proposals in the U.S. require companies to prove that the minerals in their batteries are not sourced using child labor or in environmentally destructive ways.

This has a direct impact on the cost of raw materials. Lithium, nickel, and cobalt prices are now influenced not just by supply and demand, but by “ESG (Environmental, Social, and Governance) premiums.” Batteries with high recycled content or those sourced from free-trade partners now command higher prices in the marketplace.

Recycling is no longer optional. New laws in the UK and EU mandate that at least 6% of lithium and 16% of cobalt used in new batteries must come from recycled sources by 2031, with strict reporting requirements starting now in 2025.

Corporate Fleet Mandates: The Hidden Driver of Demand

While individual consumers often get the headlines, corporate fleets are the silent engine of the transition. Many governments have introduced mandates for public sector fleets and large private corporations to electrify their vehicles by 2028.

In 2025, several countries introduced “Clean Air Zones” where heavy-duty internal combustion trucks are either banned or subject to high daily fees. This has forced logistics companies to accelerate their investment in electric vans and trucks. The financial sector has responded by creating new “Green Asset-Backed Securities” specifically for financing commercial electric fleets.

Insurance and Risk Management in the EV Era

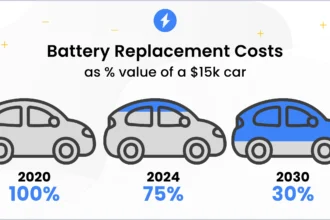

The regulatory shift is also transforming the insurance industry. Since electric vehicles often have higher repair costs and different risk profiles due to their heavy batteries, insurers are adjusting their premiums. New government safety standards for battery enclosure integrity, introduced in late 2025, aim to reduce fire risks and, consequently, lower insurance costs over time.

Investors are keeping a close eye on “Residual Value” regulations. Some European countries are considering laws that would require manufacturers to guarantee a certain level of battery health for up to ten years, which would stabilize the used EV market and make financing more attractive.

Conclusion: Preparing for 2026 and Beyond

As we move into 2026, the message from global governments is clear: the transition to electric vehicles is inevitable, but the path will be shaped by rigorous efficiency standards, supply chain transparency, and infrastructure integration. The deregulation in the United States contrasts sharply with the tightening mandates in China and Europe, creating a fragmented global market that requires careful navigation.

For businesses and investors, the “wild west” era of EV subsidies is ending. We are entering a phase of industrial maturity where efficiency, safety, and sustainability are the new metrics of success. Staying ahead of these regulations is not just about compliance: it is about securing a competitive advantage in the future of transport.