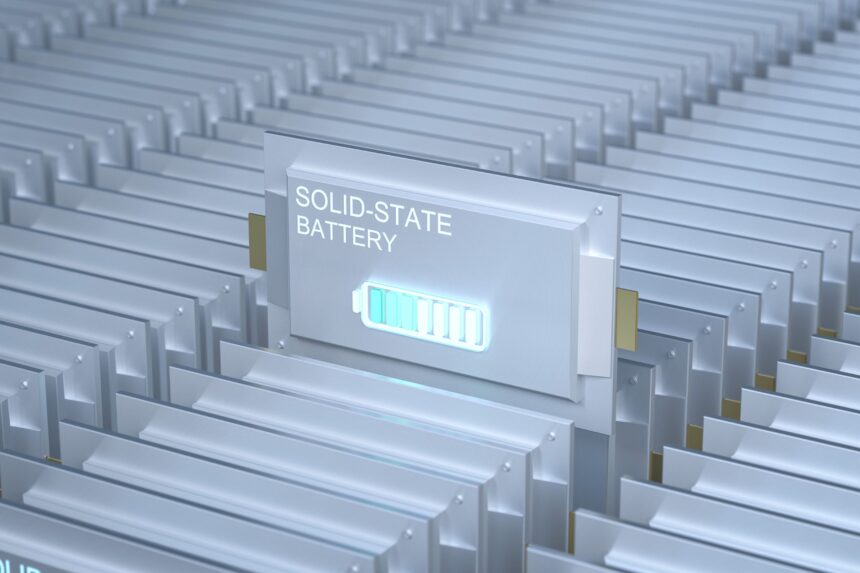

The landscape of global energy storage is undergoing its most significant transformation since the invention of the lithium-ion cell. As we enter 2026, the promise of solid state battery technology has moved from the realm of laboratory prototypes into the earliest stages of commercial reality. This year marks a critical inflection point for the automotive, consumer electronics, and renewable energy sectors as they transition toward safer, denser, and faster-charging power solutions.

- The State of Energy Storage as 2026 Begins

- Deep Dive into 2026 Battery Chemistries

- Key Market Players and Their 2026 Milestones

- The Economic Impact of Solid State Technology in 2026

- Overcoming Technical Challenges in 2026

- Solid State Batteries Beyond the Automotive Sector

- The Global Supply Chain Shift of 2026

- Technical Specifications and Performance Metrics in 2026

- Investment Outlook for 2026 and Beyond

- Conclusion: The Road Ahead After 2026

The State of Energy Storage as 2026 Begins

As of late 2025 and the start of 2026, the energy industry is witnessing a massive shift in research and development budgets. Statistics indicate that over sixty-eight percent of battery research and development is now focused specifically on solid state architectures. This shift is driven by the urgent need to overcome the inherent limitations of liquid electrolytes, which include flammability, limited energy density, and degradation under extreme temperatures.

The fundamental change in 2026 is the successful validation of sulfide-based and oxide-based electrolytes at a pilot manufacturing scale. While previous years were defined by small-scale “gram-level” testing, 2026 is the year of “ton-level” stable production. This scaling is essential for the automotive industry, where manufacturers like Toyota and NIO are pushing the boundaries of what consumers expect from an electric vehicle.

Deep Dive into 2026 Battery Chemistries

To understand the innovation of 2026, one must look at the three primary categories of solid electrolytes that have emerged as leaders in the market: sulfides, oxides, and polymers. Each offers unique advantages that cater to different high-value industries.

Sulfide Electrolytes and the Fast-Charging Frontier

Sulfide-based solid state batteries have taken the lead in the automotive sector. In 2026, these systems are prized for their superior ionic conductivity, which often exceeds that of traditional liquid electrolytes. This high conductivity allows for the 10-minute charge cycles that have long been the “holy grail” of the electric vehicle market.

Industry leaders such as Toyota have integrated sulfide technology into their 2026 battery roadmap, targeting a twenty percent increase in cruising range and significantly reduced charging times. The primary challenge being solved in 2026 involves the moisture sensitivity of sulfide materials. New hermetic sealing techniques and advanced packaging have finally made these cells viable for the rigorous environment of a passenger vehicle.

Oxide Electrolytes for Maximum Safety

Oxide solid electrolytes are witnessing high adoption in sectors where safety is the absolute priority, such as medical devices and aerospace. Because oxides are non-flammable and extremely stable, they offer a fifty percent higher safety margin compared to traditional chemistries. In 2026, we are seeing these batteries used in wearable health monitors and high-end consumer electronics that require a longer lifecycle, often up to seventy percent longer than previous generations.

Polymer Systems and Manufacturing Scalability

Polymer electrolytes remain the most cost-effective option for mass production. In 2026, nearly half of the solid state batteries used in portable electronics utilize polymer designs. While they traditionally required higher operating temperatures, 2026 has brought the introduction of “ambient temperature” polymers that can function efficiently in standard conditions, making them ideal for the next generation of smartphones and laptops.

Key Market Players and Their 2026 Milestones

The competitive landscape of 2026 is dominated by a few key players who have successfully navigated the “valley of death” between research and commercialization.

QuantumScape and the Eagle Line Inauguration

One of the most anticipated events of early 2026 is the full-scale inauguration of QuantumScape’s “Eagle Line.” This production facility, located in San Jose, utilizes the company’s proprietary Cobra separator process. This technology is a high-throughput, continuous-flow ceramic separator production method that finally addresses the scalability issues that plagued earlier solid state efforts.

As of early 2026, QuantumScape is beginning to generate its first significant commercial revenue through licensing agreements with top-tier global automakers. Their QSE-5 cells, which utilize a lithium-metal anode, are being integrated into test fleets that boast energy densities exceeding 400 Wh/kg.

Toyota’s 2026 Battery Roadmap

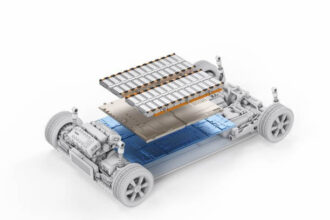

Toyota has officially entered the production phase for its next-generation battery electric vehicles in 2026. While their all-solid-state battery is scheduled for widespread release in 2027, the 2026 lineup features “Popularization” batteries that use bipolar technology and lithium iron phosphate. These serve as a bridge to the solid state era, offering a twenty percent increase in range and a forty percent reduction in cost.

Furthermore, Toyota’s collaboration with materials giants like Idemitsu Kosan has secured the supply chain for lithium sulfide, ensuring that the 2026-2027 transition to full solid state remains on track despite global supply chain fluctuations.

Samsung SDI’s Global Expansion

Samsung SDI has made a massive play for the North American market in 2026. The company has started manufacturing large-scale Battery Energy Storage Systems (BESS) in the United States. Their Samsung Battery Box (SBB) 2.0, released in 2026, utilizes proprietary prismatic form factors that maximize safety and energy density. Samsung’s pilot line for solid state cells is also providing samples to premium automakers, with an energy density target of 900 watt-hours per liter.

NIO and the 1000 Kilometer Milestone

In the Chinese market, NIO has set a new standard with its 150 kWh semi-solid-state battery pack. In 2026, this pack is available as a flexible upgrade for NIO users, allowing vehicles like the ET7 to achieve a real-world range of over 1,000 kilometers (approximately 620 miles). This breakthrough has effectively eliminated “range anxiety” for the high-end executive sedan market and has forced competitors to accelerate their own solid state timelines.

The Economic Impact of Solid State Technology in 2026

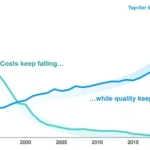

The global solid state battery market size is projected to reach approximately 2.3 billion dollars in 2026, with a compound annual growth rate exceeding thirty-eight percent. This growth is not merely a result of technological progress but is also driven by massive government support and shifting capital markets.

Investment Trends and Venture Capital

Venture capital in 2026 has shifted its focus from software-as-a-service toward “hard tech” and energy infrastructure. The massive investments in companies like Factorial Energy, Solid Power, and QuantumScape have begun to pay off as these firms reach commercial milestones. In 2026, we are seeing a trend of “strategic consolidation,” where major automotive groups are acquiring smaller battery startups to secure their intellectual property and supply chains.

The Role of Government Policy

Legislation like the Inflation Reduction Act in the United States and similar green energy initiatives in the European Union have provided a stable foundation for the 2026 battery boom. Tax credits for domestic manufacturing and subsidies for electric vehicle purchases have made the higher initial cost of solid state batteries more palatable for both manufacturers and consumers. 2026 has also seen the introduction of new recycling mandates, forcing companies to design batteries with “end-of-life” recovery in mind from the very beginning.

Overcoming Technical Challenges in 2026

Despite the progress, 2026 is a year of intense engineering work to solve the remaining hurdles of solid state technology.

Managing Dendrite Growth

The formation of lithium dendrites, microscopic needle-like structures that can cause short circuits, remains a primary focus of engineering teams. In 2026, the industry has turned toward “self-healing” electrolytes and advanced ceramic separators that are mechanically robust enough to prevent dendrite penetration. These innovations have extended the cycle life of solid state cells to over 1,000 charge cycles, making them comparable to traditional lithium-ion batteries.

Interface Resistance and Pressure Management

A unique challenge for solid state batteries in 2026 is maintaining constant pressure between the solid electrolyte and the electrodes. As the battery charges and discharges, the materials expand and contract. Engineers have developed innovative “active pressure management” systems within the battery packs to ensure optimal contact, which is crucial for maintaining high ionic conductivity and preventing power drops.

Reducing Manufacturing Costs

While the performance of solid state batteries is superior, their cost in early 2026 remains higher than traditional liquid cells. To combat this, manufacturers are leveraging “dry electrode” coating processes and highly automated production lines, such as QuantumScape’s Eagle Line, to reduce waste and increase throughput. The goal for late 2026 and 2027 is to achieve cost parity with high-nickel lithium-ion cells.

Solid State Batteries Beyond the Automotive Sector

While electric vehicles are the primary driver of the 2026 battery market, other sectors are benefiting from these breakthroughs.

Consumer Electronics and Wearables

In 2026, companies like TDK have reached major milestones in miniaturized solid state cells. New batteries with 1,000 Wh/L capacity are powering the latest smartwatches and wireless earbuds, extending their operational time by orders of magnitude. These cells are much safer for devices worn close to the body, as they do not leak and are resistant to thermal runaway.

Aerospace and Urban Air Mobility

The aerospace industry is closely watching the 2026 developments in high-energy-density solid state batteries. For electric vertical takeoff and landing (eVTOL) aircraft, every gram of weight matters. The energy density of solid state cells in 2026 is finally approaching the levels required for commercially viable regional electric flight, leading to a surge in partnerships between battery makers and aerospace firms.

Grid-Scale Energy Storage

Samsung SDI and other leaders are deploying solid state technology for grid-scale storage in 2026. These systems are used to stabilize renewable energy from wind and solar farms. Because solid state batteries can operate safely in a wider range of temperatures without complex cooling systems, they are being installed in environments ranging from the high desert to the arctic, providing reliable energy wherever it is needed.

The Global Supply Chain Shift of 2026

The transition to solid state technology has necessitated a complete re-evaluation of the global battery supply chain. 2026 is the year where new players in the raw materials sector are emerging as dominant forces.

The Rise of Lithium Sulfide and Silicon Anodes

Traditional lithium-ion batteries rely heavily on graphite anodes and liquid electrolytes. In 2026, the demand has shifted toward lithium sulfide for electrolytes and silicon-based or lithium-metal anodes. This has created new opportunities for chemical giants like Albemarle and SQM, as well as specialized firms like Sila Nanotechnologies. The supply chain for these materials is becoming increasingly localized as countries seek to reduce their dependence on single-source imports.

Sustainability and Ethical Sourcing

In 2026, the “green” credentials of a battery are as important as its performance. Investors and consumers are demanding full transparency in the supply chain. This has led to the widespread adoption of “battery passports,” which track the origin and environmental impact of every gram of material used in a solid state cell. 2026 is seeing a significant reduction in the use of cobalt, with many solid state designs moving toward “cobalt-free” chemistries to improve ethical sourcing and lower costs.

Technical Specifications and Performance Metrics in 2026

For those interested in the technical details, the solid state batteries of 2026 are achieving impressive benchmarks:

- Energy Density: 400 to 500 Wh/kg (compared to 250 to 300 Wh/kg for premium liquid Li-ion).

- Volumetric Density: Up to 900 Wh/L.

- Charge Time: 10 percent to 80 percent in under 12 minutes for automotive-grade cells.

- Operating Temperature: Stable performance from negative 30 degrees Celsius to over 100 degrees Celsius.

- Cycle Life: 800 to 1,200 cycles with minimal capacity loss.

These metrics represent a generational leap in technology and are the reason why 2026 is considered the true start of the “solid state era.”

Investment Outlook for 2026 and Beyond

For investors and industry analysts, the 2026 outlook is overwhelmingly positive but requires a nuanced understanding of the technology. The market is currently split between “early movers” like NIO and Toyota and “fast followers” like General Motors and Volkswagen.

The most lucrative opportunities in 2026 are found in the mid-stream of the supply chain: the companies that produce the specialized solid electrolytes and the advanced separators. As manufacturing processes mature, these component suppliers are expected to see the highest margins. Furthermore, the expansion of solid state technology into the “Energy Storage System” (ESS) market provides a secondary growth engine that is less cyclical than the automotive industry.

Conclusion: The Road Ahead After 2026

As we look back on the developments of 2026, it is clear that the energy storage industry has fundamentally changed. The “holy grail” of battery technology is no longer a distant dream but a tangible product that is beginning to power our world.

The innovations of 2026: from QuantumScape’s Eagle Line to Toyota’s new battery roadmap: have laid the groundwork for a future of clean, safe, and efficient transportation. While challenges remain in scaling production to meet global demand, the trajectory is unmistakable. The solid state revolution is here, and 2026 will be remembered as the year it finally took flight.