The automotive landscape on this Saturday, January 3, 2026, looks vastly different than it did only two years ago. We are standing at a peculiar moment in history where the most successful vehicle on the planet, the Tesla Model Y, is simultaneously a symbol of triumph and a cautionary tale about the future of transportation. As of yesterday’s Q4 2025 delivery report, the reality of the market has set in: Tesla delivered 418,227 vehicles in the final quarter, bringing their annual total to 1.64 million units. This represents a 9% decline compared to 2024, confirming that for the second year in a row, the pioneer of the electric revolution is facing a contraction in its core business while rivals like BYD surge ahead with 2.26 million battery electric vehicles sold in the same period.

- The Model Y Juniper Refresh: A Study in Refined Engineering

- Analyzing the 2025 Sales Data and Market Shift

- The Risk of Technical Overreach: Robotics vs. Mobility

- Comparing the Model Y to the 2026 Competitive Landscape

- The Financial Implications of the Autonomous Pivot

- Insurance and Liability in the Age of Autonomy

- Sustainable Manufacturing and the “Unboxed” Process

- The Importance of the Human Experience in Driving

- Live Update: The State of the Market on January 3, 2026

- Future Outlook: The 2026 and 2027 Roadmap

- Conclusion: Finding the Balance

The primary takeaway from the latest data is not just about the numbers but about the soul of the machine. The 2026 Tesla Model Y, recently refreshed under the internal codename Juniper, is perhaps the most refined version of a crossover ever built. Yet, there is a growing sentiment among engineers, critics, and luxury vehicle enthusiasts that the Austin-based company has become so enamored with the idea of being a robotics and artificial intelligence firm that it has forgotten what it means to be a premier car manufacturer. This article explores why the Model Y proves that for Tesla to maintain its market dominance, it must return to the fundamental art of making cars.

The Model Y Juniper Refresh: A Study in Refined Engineering

The launch of the 2026 Model Y “Juniper” update has been the most anticipated event in the electric SUV segment. Tesla has finally addressed long-standing complaints regarding ride quality and interior ambiance. By integrating the frequency-dependent dampers and torsional stiffness enhancements first seen in the Model 3 “Highland” update, the 2026 Model Y finally offers a ride that can compete with European luxury crossovers.

In terms of physical changes, the 2026 model introduces a striking front light bar inspired by the Cybertruck, replacing the older, more rounded headlight units. The hood has been resculpted for better aerodynamics, and the removal of all external badging gives the vehicle a minimalist, high-tech aesthetic that aligns with modern sustainable luxury trends.

Internally, the transformation is even more significant. Tesla has swapped out the previous hard plastics and wood trims for premium cloth, faux suede, and refined materials that finally justify the vehicle’s price point. The inclusion of ventilated front seats, a dedicated 8-inch rear passenger display, and wrap-around ambient lighting has elevated the cabin experience. However, the omission of a physical instrument cluster and the continued lack of smartphone mirroring software remain points of contention for traditional buyers.

Analyzing the 2025 Sales Data and Market Shift

The delivery figures released on January 2, 2026, provide a sobering look at the competitive landscape. Tesla’s 1.64 million deliveries for 2025 missed even the lowered expectations of Wall Street analysts. Meanwhile, Chinese manufacturer BYD has effectively captured the crown of the world’s largest electric vehicle maker. This shift is largely attributed to BYD’s aggressive vertical integration and a diverse product lineup that spans every price point from budget hatchbacks to ultra-luxury SUVs.

For Tesla, the Model Y and Model 3 continue to represent over 97% of its total production. This reliance on two aging platforms, despite the recent refreshes, highlights a lack of variety that traditional automakers like Ford, GM, and Hyundai are beginning to exploit. The end of the federal electric vehicle tax credit program in the United States in October 2025 also dealt a significant blow to Tesla’s domestic sales momentum, forcing the company to rely more heavily on international markets where competition is even more fierce.

The Risk of Technical Overreach: Robotics vs. Mobility

Elon Musk has frequently stated that Tesla should be viewed as an AI and robotics company rather than an automaker. This vision is centered on the development of the “Cybercab” robotaxi, the “Optimus” humanoid robot, and the pursuit of unsupervised Full Self-Driving (FSD) capability. While these projects have kept the company’s stock valuation at levels that defy traditional automotive metrics, they have also diverted immense resources away from vehicle hardware development.

The “Cybercab,” expected to enter mass production by April 2026, features a design without a steering wheel or pedals. While technologically impressive, the regulatory hurdles for such a vehicle are monumental. Critics argue that by focusing so heavily on a future of autonomous fleets, Tesla is neglecting the millions of consumers who want a high-quality, dependable, and driver-focused vehicle today. The Model Y, while excellent, is essentially a five-year-old design that is being pushed to its limits through software and minor aesthetic tweaks.

Comparing the Model Y to the 2026 Competitive Landscape

In early 2026, the competitive set for the Model Y is more formidable than ever. The Hyundai Ioniq 5, recently updated with a rear wiper and a more plush ride, remains a top choice for those who value ergonomics and fast-charging architecture. The Ford Mustang Mach-E has also gained ground, offering a more traditional driving feel and a robust dealer service network that many first-time electric vehicle buyers find comforting.

Comparative Performance Metrics (January 2026)

- Tesla Model Y Performance: 0 to 60 mph in 3.3 seconds, 306-mile range, starting at $59,130.

- Hyundai Ioniq 5 N: 0 to 60 mph in 3.2 seconds, 220-mile range, starting at $68,000.

- Rivian R1S Dual-Motor: 0 to 60 mph in 3.4 seconds, 315-mile range, starting at $75,900.

- BYD Sea Lion 07: 0 to 60 mph in 4.4 seconds, 340-mile range (WLTP), starting at approximately $45,000 (international markets).

The data shows that while Tesla still leads in efficiency and software integration, the gap in performance and range is narrowing. Brands like Rivian are winning over the premium lifestyle segment, while BYD is dominating on price and manufacturing scale.

The Financial Implications of the Autonomous Pivot

From an investment and asset management perspective, Tesla’s shift toward AI and robotics creates a high-risk, high-reward scenario. The “TeraFab” semiconductor facility, recently announced by Tesla, aims to produce in-house AI chips to power the next generation of autonomous systems. This level of vertical integration is unprecedented in the automotive world and could significantly lower the cost of autonomous hardware.

However, the cost of this innovation is reflected in the company’s automotive revenue, which dropped from $77 billion in 2024 to approximately $70.8 billion in 2025. Investors are essentially betting that the future revenue from robotaxi networks and humanoid labor will far outweigh the losses in the traditional car market. For the average consumer looking to purchase a reliable SUV with high resale value, this corporate pivot can be unsettling.

Insurance and Liability in the Age of Autonomy

As Tesla pushes toward “Unsupervised FSD” in 2026, the conversation around vehicle insurance and legal liability is reaching a fever pitch. Traditional automotive insurance policies are based on human error and driver history. When a vehicle operates autonomously, the liability shifts toward the manufacturer and the software provider.

Tesla’s in-house insurance product uses real-time driving behavior to calculate premiums, which has been a major selling point for Model Y owners. However, as the vehicle takes more control, the legal frameworks in North America and Europe are struggling to keep up. Potential buyers in 2026 must consider the long-term implications of owning a vehicle whose primary feature is a software suite that is still undergoing rapid regulatory scrutiny.

Sustainable Manufacturing and the “Unboxed” Process

One area where Tesla continues to lead as a “car maker” is in manufacturing innovation. The new “unboxed” manufacturing process, which will be used for the Cybercab and the upcoming $30,000 affordable model (often referred to as the Model 2), aims to reduce factory footprints and production costs by 50%.

By painting only the necessary parts and assembling the vehicle in sub-sections that only come together at the final stage, Tesla is attempting to reinvent the assembly line that Henry Ford popularized over a century ago. If successful, this will allow Tesla to produce vehicles with higher profit margins than any competitor, even in a lower-priced segment. This is the kind of “car making” innovation that enthusiasts want to see applied to the entire lineup, not just future experimental projects.

The Importance of the Human Experience in Driving

The core argument of the “Get Back to Making Cars” movement is that a vehicle is more than just a computer on wheels. It is a space for travel, family, and personal expression. The 2026 Model Y’s interior improvements are a step in the right direction, but the reliance on a single screen for every function, from adjusting mirrors to selecting gears, remains a hurdle for many.

The automotive industry is seeing a slight “physical button” resurgence in 2026, with brands like Porsche and even Hyundai reintroducing tactile controls for essential functions. Consumers are reporting “screen fatigue,” and the desire for a more tactile, intuitive driving experience is growing. Tesla’s refusal to include an instrument cluster or a head-up display in the Model Y is seen by some as a dogmatic commitment to minimalism over user-centric design.

Live Update: The State of the Market on January 3, 2026

As of this morning, Tesla’s stock is showing resilience despite the delivery miss, primarily due to the excitement surrounding the “Optimus” robot demonstrations and the confirmed April start date for Cybercab production. In the used car market, the pre-refresh Model Y is seeing a slight dip in value as the “Juniper” models begin to hit showrooms in higher volumes.

In Europe, the Model Y L (the six-seat long-wheelbase variant) has just received regulatory approval for production at Giga Berlin. This model is expected to be a major growth driver for the European market in the first half of 2026, as it provides a much-needed option for families who require more utility than the standard five-seat configuration provides but are not ready to step up to the much more expensive Model X.

Future Outlook: The 2026 and 2027 Roadmap

Looking ahead, the next eighteen months will be the most critical in Tesla’s history. The roadmap includes:

- Q1 2026: Broad release of FSD V14-Lite for Hardware 3 vehicles, bringing smoother visualizations and improved urban navigation.

- April 2026: Expected start of Cybercab production at Giga Texas using the unboxed manufacturing method.

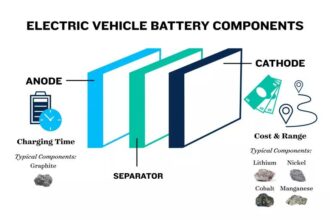

- Mid-2026: Launch of the next-generation 4680 battery cells (NC05 variant) with dry cathode technology, promising a 15% increase in range.

- Late 2026: The potential arrival of the “Model 2,” a sub-$30,000 compact vehicle designed for global mass-market adoption.

- 2027: Full-scale production of the Tesla Semi and the potential relaunch of the next-generation Roadster.

Conclusion: Finding the Balance

The Tesla Model Y remains an incredible feat of engineering and the benchmark for what a modern electric SUV can be. It is efficient, safe, and technologically superior to almost anything on the road. However, the 2025 sales decline and the rapid rise of competitors like BYD and Hyundai serve as a wake-up call.

Tesla does not need to abandon its dreams of AI and robotics, but it does need to ensure that its core product, the car, continues to evolve in ways that matter to drivers. This means focusing on build quality, tactile ergonomics, and a diverse lineup that caters to more than just the tech-savvy early adopter. By getting back to the fundamentals of what makes a car great, Tesla can ensure that the Model Y is not just the end of an era, but the beginning of a more mature and sustainable future for the brand.