The global automotive sector is currently navigating one of the most significant transformations in industrial history. As of late December 2025, the transition from internal combustion engines to electric propulsion has moved beyond a niche trend and into the primary driver of global manufacturing and consumer demand. This shift is not just about environmental stewardship; it is a complex intersection of national security, economic policy, and technological supremacy.

- Norway: The Undisputed Global Blueprint for Electrification

- China: The Global Powerhouse of Production and Innovation

- Germany: The Industrial Giant Reclaiming Its Momentum

- United Kingdom: Navigating Policy and Infrastructure Challenges

- United States: Innovation Amidst Regulatory Uncertainty

- Emerging Leaders: Denmark, Sweden, and Thailand

- The Technological Frontier: Solid State and Autonomous Integration

- The Financial Landscape: Investment and Insurance in the EV Era

- Conclusion: A Multi Speed Global Transition

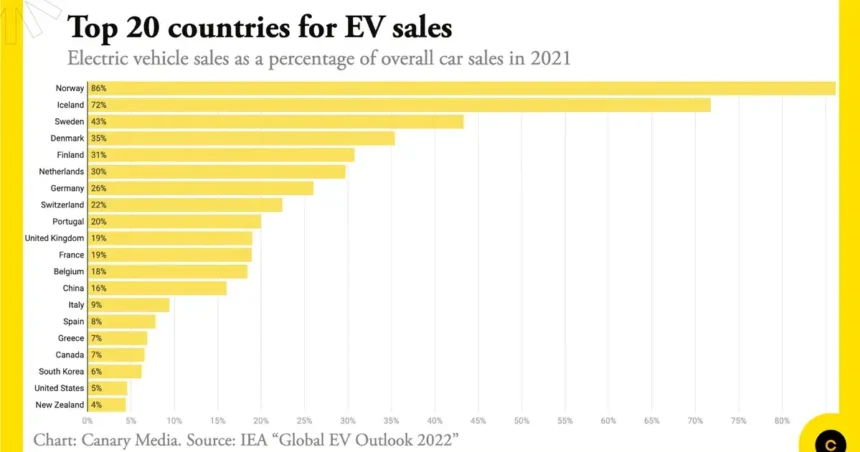

For investors, policymakers, and consumers, understanding which countries are leading this expansion provides a roadmap for the future of transportation. By examining the latest data from the final quarter of 2025, we can see a clear divergence between those nations that have committed fully to a zero emission future and those still grappling with the logistical and political challenges of such a massive infrastructure overhaul.

Norway: The Undisputed Global Blueprint for Electrification

Norway continues to hold its position as the world leader in electric vehicle adoption, reaching milestones that were considered impossible only a decade ago. In September 2025, battery electric vehicles (BEVs) accounted for a staggering 98.3 percent of all new passenger car sales in the country. This is the highest share ever recorded in a single month globally.

The Norwegian success story is built on a foundation of consistent policy and a unique economic environment. Unlike many other nations, Norway does not have a large domestic automotive manufacturing lobby, which allowed the government to implement aggressive policies without the friction found in Germany or the United States.

The primary driver has been a comprehensive fiscal strategy. For years, electric vehicles were exempt from Value Added Tax (VAT) and high purchase taxes. While some of these incentives have been adjusted as the market matured, the cost of owning a traditional petrol or diesel car remains prohibitively high compared to an EV. Furthermore, the infrastructure development has been exemplary. As of mid-2025, Norway boasts over 34,000 public charging points, with high speed DC chargers spaced every 50 kilometers along major roads.

This saturation has led to a fascinating market dynamic. The Tesla Model Y remains the top seller, but there is fierce competition from brands like Volvo, Volkswagen, and increasingly, Chinese manufacturers like BYD and MG. With 28.9 percent of all cars on Norwegian roads now being fully electric, the country is on track to reach its goal of 100 percent zero emission new car sales well before its 2027 target.

China: The Global Powerhouse of Production and Innovation

While Norway leads in percentage of sales, China dominates in sheer volume and supply chain control. In 2025, China officially surpassed Japan as the world’s largest automotive exporter, a feat driven almost entirely by its dominance in the New Energy Vehicle (NEV) sector.

By the end of October 2025, cumulative EV sales in China reached 10.3 million units for the year, representing a 22 percent increase over 2024. Perhaps more importantly, the domestic market share for NEVs in China has now crossed the 50 percent threshold for passenger cars. This means that for the first time in history, more than one out of every two new cars sold in the world’s largest car market is electrified.

The secret to China’s success lies in vertical integration. Companies like BYD, which now commands over 34 percent of the domestic market, do not just build cars; they manufacture the batteries, the semiconductors, and the electric motors. This control over the value chain allows for aggressive pricing that Western manufacturers struggle to match.

The technological shift within China is also notable. In 2025, Lithium Iron Phosphate (LFP) batteries reached an 81.4 percent market share in China made vehicles, effectively ending the dominance of traditional Nickel Manganese Cobalt (NMC) chemistries for all but the most high end luxury models. This shift has significantly lowered the entry price for EVs, making them accessible to a much broader segment of the population.

Germany: The Industrial Giant Reclaiming Its Momentum

Germany faced a difficult 2024 following the sudden end of consumer subsidies, but 2025 has seen a remarkable rebound. By November 2025, new registrations of battery electric vehicles in Germany rose to approximately 490,000 units, marking a record for the country.

The German market is currently undergoing a shift toward corporate and fleet electrification. While private buyer demand stabilized, the commercial sector has embraced EVs as total cost of ownership (TCO) benefits become more apparent. The Volkswagen Group continues to dominate the domestic landscape, with its ID series holding the top five spots for fully electric models.

Germany’s role in the EV expansion is also tied to its massive investment in battery production. The “Battery Valley” initiatives in regions like Lower Saxony and Brandenburg are now coming online, aiming to reduce dependence on East Asian suppliers. Furthermore, Germany’s luxury brands, including Mercedes Benz and BMW, have successfully transitioned their high margin models to electric platforms, with the Porsche Taycan and BMW i7 becoming benchmarks for performance and range.

The country is also leading the way in heavy duty electrification. In 2025, the European Union approved a 1.6 billion euro funding package for a German led electric truck charging hub network, which is critical for decarbonizing the logistics corridors of Central Europe.

United Kingdom: Navigating Policy and Infrastructure Challenges

The United Kingdom has seen a volatile but ultimately upward trend in 2025. After a slow start to the year, registrations surged in the third quarter, with September seeing over 116,000 new EV sales. This growth is largely driven by the Zero Emission Vehicle (ZEV) mandate, which requires manufacturers to sell an increasing percentage of electric cars each year.

The UK market is particularly strong in the corporate sector, where Benefit in Kind (BIK) tax incentives make electric cars significantly cheaper for employees than their combustion counterparts. However, the public charging network remains a point of contention. While the number of ultra rapid chargers has increased by over 40 percent in the last 12 months, regional disparities between London and the North of England persist.

One of the most exciting developments in the UK is the rise of the second hand EV market. As the first waves of three year leases come to an end, a massive influx of affordable used electric cars is hitting the market, lowering the barrier to entry for the average consumer. This “trickle down” effect is essential for reaching mass market adoption beyond the early adopters and corporate fleets.

United States: Innovation Amidst Regulatory Uncertainty

The United States remains a market of contrasts in 2025. On one hand, the country is home to the world’s most innovative EV companies, including Tesla, Rivian, and Lucid. On the other hand, the national adoption rate has faced headwinds. In the fourth quarter of 2025, US EV sales saw a slight decline compared to the record breaking third quarter, largely due to the expiration or narrowing of certain federal tax credits under the Inflation Reduction Act (IRA).

Despite these fluctuations, the long term trajectory remains positive. The IRA has triggered a “gold rush” of domestic manufacturing investment. Dozens of new battery “gigafactories” are currently under construction across the American Southeast, often referred to as the “Battery Belt.” This domestic supply chain is intended to make the US less reliant on foreign minerals and components.

Tesla’s Model Y continues to be the best selling vehicle in several states, including California, where EV market share is significantly higher than the national average. Meanwhile, the arrival of electric pickup trucks like the Chevrolet Silverado EV and the Ford F-150 Lightning has begun to tap into the most profitable and popular segment of the American automotive market.

Emerging Leaders: Denmark, Sweden, and Thailand

While the major economies grab the headlines, several other nations are making quiet but significant strides.

- Denmark: In 2025, Denmark saw a massive 46.9 percent year over year growth in EV sales, with the electric market share reaching 63.8 percent. The Danish government’s commitment to green energy and a highly urbanized population makes it an ideal environment for EV expansion.

- Sweden: Despite some recent policy adjustments, one in every three cars sold in Sweden is now fully electric. The country’s domestic champion, Volvo, has been one of the first legacy automakers to commit to becoming a fully electric brand by 2030.

- Thailand: Thailand has emerged as the EV hub of Southeast Asia. By offering significant incentives to both manufacturers and consumers, the Thai government has successfully attracted investment from both Chinese and Japanese automakers. In 2025, EV sales in Thailand surged by over 50 percent, led by affordable models that are now being exported throughout the region.

The Technological Frontier: Solid State and Autonomous Integration

As we look at the leaders of the 2025 market, we must also consider the technology that will define the next phase of expansion. Two key areas are currently dominating the conversation: battery chemistry and artificial intelligence.

Solid state batteries have moved from the laboratory to pilot production. Several Chinese and Japanese manufacturers have announced plans for limited scale deployment in high end models by 2026. These batteries promise higher energy density, faster charging times, and improved safety compared to current liquid electrolyte cells.

Furthermore, the integration of Level 3 and Level 4 autonomous driving systems is becoming a major differentiator. In markets like China and the US, the “software defined vehicle” is the new standard. Consumers are increasingly making purchasing decisions based on the car’s digital ecosystem and its ability to handle complex driving tasks automatically.

The Financial Landscape: Investment and Insurance in the EV Era

The expansion of the EV market has profound implications for the broader financial sector. For investors, the focus has shifted from high growth startups to the established players that have successfully managed the transition. Lithium mining and processing remain critical areas of interest, though the market has stabilized somewhat as new supply from South America and Australia comes online.

The insurance industry is also adapting to the unique risks and costs associated with electric vehicles. While EVs are generally safer in terms of crash protection, the cost of repairing complex battery packs can be significantly higher than traditional engines. This has led to a new niche of specialized EV insurance products that offer better rates for drivers with advanced safety systems.

Additionally, the rise of Vehicle to Grid (V2G) technology is turning electric cars into financial assets. By allowing car owners to sell excess electricity back to the grid during peak demand, EVs are becoming an integral part of the smart grid, providing both a revenue stream for the owner and stability for the energy provider.

Conclusion: A Multi Speed Global Transition

The data from 2025 confirms that the world is moving toward an electric future, but it is doing so at multiple speeds. Norway and China have already passed the point of no return, while Europe and the United States are in a middle phase of consolidation and infrastructure building.

The leaders of the EV market are not just those with the best cars, but those with the most cohesive policies, the most resilient supply chains, and the most comprehensive charging networks. As we move toward 2030, the gap between the leaders and the laggards will likely widen, with significant economic consequences for the global automotive industry.

For those looking to stay ahead of the curve, monitoring these leading nations provides the clearest indication of where the technology, the capital, and the infrastructure will flow next.