The automotive landscape is undergoing its most significant transformation since the invention of the internal combustion engine. As of late December 2025, the shift toward sustainable transportation has moved from a niche market to a global standard. Today, nearly one in five new vehicles sold globally is powered by electricity, with emerging markets in Southeast Asia and Latin America rapidly joining the ranks of established leaders like Norway, China, and Germany. For the modern consumer, investor, or fleet manager, understanding the nuances between different electrified platforms is no longer optional: it is essential for making informed financial and logistical decisions.

- The Architecture of Battery Electric Vehicles (BEV)

- Understanding Hybrid Electric Vehicles (HEV)

- The Versatility of Plug-in Hybrid Electric Vehicles (PHEV)

- Fuel Cell Electric Vehicles (FCEV): The Hydrogen Frontier

- Comparing the Total Cost of Ownership (TCO) in 2025

- Global Market Trends and Live Daily Information

- Which Technology is Right for You?

- Industry Sources and Further Reading

- Conclusion

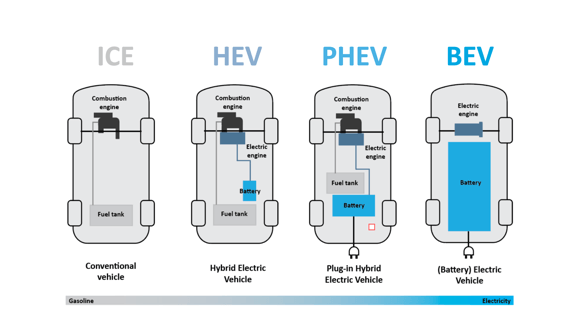

This exhaustive guide explores the four primary pillars of modern vehicle electrification: Battery Electric Vehicles (BEV), Hybrid Electric Vehicles (HEV), Plug-in Hybrid Electric Vehicles (PHEV), and Fuel Cell Electric Vehicles (FCEV). We will delve into their technical architectures, total cost of ownership, market trends for 2025, and how these technologies fit into the broader global energy transition.

The Architecture of Battery Electric Vehicles (BEV)

Battery Electric Vehicles represent the purest form of the electric revolution. Unlike traditional cars, a BEV lacks an internal combustion engine (ICE). Instead, it relies entirely on a large on-board battery pack to power one or more electric motors.

Technical Foundation and Power Delivery

In a BEV, the battery pack is typically located along the floor of the vehicle, creating a low center of gravity that significantly enhances handling and safety. In 2025, we are seeing the first commercial implementations of semi-solid-state batteries, which offer higher energy density and faster charging than the lithium-ion standards of the previous decade.

The efficiency of a BEV is unmatched. While an internal combustion engine loses about 70 percent of its energy to heat and friction, an electric motor converts over 85 percent of the electrical energy from the battery into motion. This efficiency translates directly into lower energy costs for the owner.

Range and Charging Infrastructure in late 2025

Range anxiety is becoming a relic of the past. High-end models like the 2026 Mercedes CLA Electric now boast ranges exceeding 480 miles on a single charge. Even entry-level models are standardizing at 250 to 300 miles.

Charging technology has also seen a massive leap. The 800-volt architecture, once reserved for luxury models like the Porsche Taycan, is now filtering down to more affordable segments. This allows for ultra-fast charging speeds where a driver can add 200 miles of range in roughly 10 to 12 minutes at a compatible DC fast charger.

Maintenance and Long Term Reliability

One of the most compelling financial arguments for BEV ownership is the reduced maintenance requirement. A BEV has approximately 20 moving parts in its drivetrain, compared to over 2,000 in a traditional gasoline vehicle. There are no oil changes, spark plugs, timing belts, or exhaust systems to maintain. Regenerative braking, which uses the motor to slow the car down while recharging the battery, also significantly extends the life of brake pads and rotors.

Understanding Hybrid Electric Vehicles (HEV)

Hybrid Electric Vehicles are often considered the “no-plug” solution. They combine a traditional gasoline engine with an electric motor and a small battery. The vehicle cannot be plugged into an external power source: instead, the battery is charged through regenerative braking and the internal combustion engine itself.

The Role of the Internal Combustion Engine

In an HEV, the electric motor serves as a support system. It handles low-speed maneuvers and provides an extra boost during acceleration. This allows the gasoline engine to operate in its most efficient range or shut off entirely when the vehicle is idling or coasting.

Market Popularity and Resale Value

In 2025, HEVs remain incredibly popular because they require zero change in consumer behavior. You fill them up at a gas station just like a traditional car, but you achieve significantly better fuel economy. For example, modern hybrid sedans frequently achieve 50 to 60 miles per gallon in city driving.

From a financial perspective, HEVs currently hold some of the highest residual values in the automotive market. They are seen as a safe “middle ground” for buyers who want efficiency but are not ready to commit to charging infrastructure.

Limitations of the HEV Platform

While efficient, an HEV is still fundamentally a gasoline-dependent vehicle. It cannot operate for long distances on electricity alone (usually only a mile or two at very low speeds). Furthermore, because it contains both an engine and an electric system, it retains the maintenance complexities of a traditional vehicle, including oil changes and emissions systems.

The Versatility of Plug-in Hybrid Electric Vehicles (PHEV)

Plug-in Hybrids represent a strategic bridge between the hybrid and the fully electric experience. They feature a larger battery than a standard HEV and a charging port that allows them to be plugged into the grid.

The Dual-Drive Advantage

A PHEV typically offers an all-electric driving range of 30 to 60 miles. For the average commuter who drives less than 40 miles a day, a PHEV can function effectively as a BEV during the work week. However, for long road trips, the gasoline engine takes over once the battery is depleted, eliminating any concerns about finding a charging station.

Efficiency and Performance

The 2025 models, such as the latest iterations of the Toyota RAV4 Prime or the BMW 330e, have optimized the transition between electric and gasoline power to be virtually seamless. Many luxury manufacturers are using the electric motor in PHEVs to enhance performance, providing instant torque that complements the high-speed power of the combustion engine.

Financial Considerations and Tax Incentives

In many jurisdictions, PHEVs still qualify for significant tax credits, though often at a lower rate than full BEVs. They are particularly attractive for households with only one vehicle, as they offer the most flexibility. However, it is important to note that to get the most financial benefit from a PHEV, owners must be diligent about plugging it in daily. If driven primarily on gasoline, the extra weight of the large battery actually makes them less efficient than a standard HEV.

Fuel Cell Electric Vehicles (FCEV): The Hydrogen Frontier

Fuel Cell Electric Vehicles are the outliers of the current market, but they hold immense potential for specific sectors. Instead of storing energy in a battery, an FCEV generates electricity on-board through a chemical reaction between compressed hydrogen and oxygen from the air. The only byproduct is pure water vapor.

Refueling vs. Charging

The primary advantage of an FCEV is the refueling speed. Filling a hydrogen tank takes about 3 to 5 minutes, similar to a gasoline car, and provides a range of 300 to 400 miles. This makes hydrogen an attractive solution for heavy-duty trucking, public transit, and long-haul logistics where downtime for charging is not feasible.

Challenges in 2025: Infrastructure and Cost

As of December 2025, the passenger FCEV market has faced headwinds. In regions like California, infrastructure challenges and high hydrogen fuel prices have led to a decrease in consumer sales for models like the Toyota Mirai. However, in China and parts of the European Union, the focus has shifted toward commercial applications. Large-scale “hydrogen corridors” are being established for freight trucks, where the weight of massive batteries would otherwise reduce the vehicle’s payload capacity.

The Future of Green Hydrogen

The viability of FCEVs is tied to the production of “green hydrogen,” which is produced using renewable energy through electrolysis. As the cost of electrolyzers drops in 2026 and beyond, we may see a resurgence in hydrogen technology for specialized industrial and luxury applications.

Comparing the Total Cost of Ownership (TCO) in 2025

When choosing between these four technologies, the initial sticker price is only one part of the equation. A comprehensive financial analysis must include fuel costs, maintenance, insurance, and depreciation.

Purchase Price and Incentives

In early 2025, the average transaction price for a BEV was approximately 59,200 dollars, while standard hybrids averaged around 33,000 dollars. However, the 7,500 dollar federal tax credit in the United States and similar ecological bonuses in Europe (ranging from 2,000 to 6,000 euros depending on income) significantly narrow this gap.

Energy and Fuel Costs

Electricity remains significantly cheaper than gasoline or hydrogen in most global markets. On average, a BEV owner spends between 500 and 850 dollars per year on energy, while a hybrid owner may spend between 1,100 and 1,500 dollars. These savings accumulate over the life of the vehicle, often making the BEV the more economical choice after 5 to 7 years of ownership.

Insurance and Depreciation

Insurance premiums for high-performance electric vehicles can be higher due to their advanced technology and repair costs. However, as repair networks expand in 2025, these costs are beginning to stabilize. Depreciation varies: luxury BEVs like those from Tesla or Porsche hold their value well due to over-the-air software updates that keep the vehicle feeling “new,” whereas older battery tech models may see steeper declines.

Global Market Trends and Live Daily Information

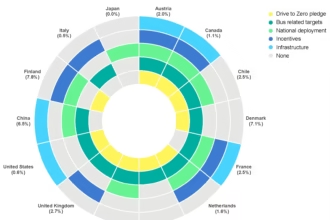

As we look at the data from the final quarter of 2025, several key trends are defining the industry:

- The Rise of Emerging Markets: Countries like Vietnam, Singapore, and Thailand have seen EV sales shares reach nearly 40 percent this year, overtaking several European nations. This is driven by aggressive local manufacturing and government mandates.

- Solid-State Progress: Leading manufacturers have announced that 2026 will be the year of mass-market solid-state battery testing, promising ranges of over 600 miles and 5-minute charge times.

- The Battery Oversupply: A global surplus of battery raw materials like lithium and cobalt has led to a drop in battery pack prices to below 100 dollars per kWh, a crucial milestone for price parity with gasoline cars.

- Hydrogen Refocus: While passenger hydrogen cars are struggling in the US, the “Global Hydrogen Car Sales” report shows that heavy-duty hydrogen truck sales in China grew significantly in H1 2025, representing nearly 50 percent of the global FCEV market.

Which Technology is Right for You?

Choosing the right platform depends on your specific lifestyle and financial goals:

- Choose a BEV if: You have access to home or workplace charging, drive frequently, and want the lowest possible operating and maintenance costs.

- Choose an HEV if: You live in an apartment without charging access, take frequent long trips, and want a high-efficiency vehicle with a lower initial purchase price.

- Choose a PHEV if: You have a short daily commute that can be done on electricity but require a single vehicle that can also handle 500-mile road trips without stopping to charge.

- Choose an FCEV if: You are a fleet operator or a specialized user in a region with robust hydrogen infrastructure, such as certain parts of Japan, Germany, or China.

Industry Sources and Further Reading

For those looking to dive deeper into the technical data and real-time market shifts, the following organizations provide the most reliable information as of late 2025:

- PwC Autofacts: Global Electric Vehicle Sales Review (Q2-2025 and beyond)

- Ember Energy: Reports on Emerging Markets and the Global EV Race

- International Energy Agency (IEA): Global EV Outlook 2025

- Fortune Business Insights: Electric Vehicle Market Size and Growth Projections (2025-2032)

- SNE Research: Tracking Fuel Cell and Battery Market Shares

Conclusion

The transition to electrified transport is no longer a “future” event: it is the current reality of the 2025 automotive market. Whether you prioritize the zero-emission purity of a BEV, the versatile convenience of a PHEV, the familiar efficiency of an HEV, or the industrial potential of an FCEV, the options have never been more diverse or more capable. By understanding the financial and technical implications of each, you can position yourself at the forefront of the green energy movement while optimizing your long-term mobility costs.