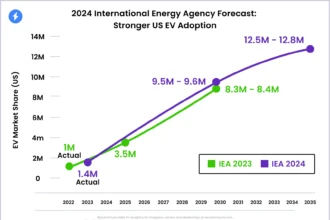

The automotive landscape is no longer just shifting; it has fundamentally broken from its past. As we look toward 2026, the “early adopter” phase of electric mobility is officially dead. We are now entering the era of mass adoption, defined by ruthless competition, software-defined chassis systems, and a complete reimagining of vehicular finance. For investors and enthusiasts alike, 2026 represents a critical year where winners will separate themselves from the noise.

This guide is not just about cars. It is about the companies redefining energy, insurance, and personal capital in the coming year.

The State of Electric Mobility in 2026

We are witnessing a maturation of the market. The speculative frenzy of the early 2020s has settled into a “prove it” economy. Capital is expensive, and startups can no longer run on promises alone. The companies listed below are those that have either secured the necessary runway to survive or are backed by legacy giants with deep pockets.

For the savvy investor or the prospective buyer, the focus must shift from “range anxiety” to “platform stability.” We are looking at who owns the software, who controls the battery supply chain, and who offers the best long-term value retention.

1. Rivian Automotive (NASDAQ: RIVN)

The Mass Market Pivot

Rivian has survived the “production hell” that claims so many automotive startups. By 2026, the conversation around Rivian shifts from their flagship R1T and R1S luxury trucks to their mass-market contenders: the R2 and the R3.

The R2 and R3 Platform

The R2 is the vehicle that Wall Street has been waiting for. With a starting price point expected to hover around the $45,000 to $50,000 mark, it directly challenges the Model Y domination. But the real surprise for 2026 is the R3 and its performance variant, the R3X. These vehicles utilize a new midsize platform that reduces manufacturing complexity by 60%.

Why Watch Them:

- Volume scaling: 2026 is the year Rivian attempts to triple its output.

- Cost efficiency: The Peregrine drive unit and simplified network architecture are designed to push margins into positive territory.

Financial Outlook

For traders, RIVN in 2026 represents a classic value play in the growth sector. The stock has historically been volatile, but with the Georgia plant coming online and the affordable R2 hitting driveways, the revenue diversification makes it a prime candidate for portfolio stabilization.

2. Lucid Group (NASDAQ: LCID)

Saudi-Backed Luxury and Efficiency Kings

Lucid has always had the best technology in the game. Their motors are smaller, lighter, and more efficient than anything else on the road. The problem was always price. In 2026, the narrative expands with the full-scale arrival of the Lucid Gravity SUV.

The Gravity SUV

The Gravity is not just an SUV; it is a showcase of packaging efficiency. It offers seating for seven adults and their luggage, a feat few EV SUVs can claim without looking like a bus. With range estimates surpassing 440 miles, it effectively kills range anxiety for the luxury demographic.

Key Specs to Note:

- Architecture: 900V system allows for ultra-fast charging (adding 200 miles in under 15 minutes).

- Market Position: Competing directly with the high-end European legacy brands.

The Investment Angle

Lucid is a unique case study in corporate finance due to its backing by the Public Investment Fund (PIF) of Saudi Arabia. This provides a “capital floor” that other startups lack. Investors should watch for the licensing of Lucid’s powertrain technology to other automakers (Aston Martin was the first) as a high-margin revenue stream that could boost stock valuation independent of vehicle sales.

3. Sony Honda Mobility: Afeela

The Software-Defined Vehicle Realized

If you want to understand where car insurance and entertainment are going, look at Afeela. A joint venture between Sony and Honda, Afeela is not selling a car; they are selling a rolling digital ecosystem.

The “Afeela 1” Sedan

Set for mid-2026 deliveries, the Afeela 1 is priced around $89,900. It features a “Media Bar” on the front bumper that can display information to pedestrians and other drivers. But the interior is where the disruption happens. Powered by Epic Games’ Unreal Engine, the dashboard is a continuous screen designed for immersive entertainment and gaming.

Why It Matters for Industry Trends:

- Recurring Revenue: Sony plans to monetize the time you spend charging or in autonomous mode with movies, games, and subscriptions.

- Sensor Suite: With 45 cameras and sensors, Afeela is pushing the boundaries of ADAS (Advanced Driver Assistance Systems). This level of sensing capability is expected to drastically lower accident rates, potentially influencing EV insurance premiums.

4. Scout Motors

Nostalgia Meets High Voltage

Volkswagen Group resurrected the iconic American “Scout” brand to capture the rugged off-road market that Rivian and the Cybertruck opened up. While production fully ramps in 2027, 2026 is the critical year for their “Scout Studios” retail footprint and pre-order conversions.

The Traveler and Terra

Scout is taking a different approach by using a body-on-frame platform that supports both pure EV and a “Harvester” range-extender option. This addresses the towing concerns of truck owners who tow heavy loads, which typically decimates battery range.

Financial Implication:

This is a direct play on the American heartland consumer. By offering a gas-range extender, Scout bridges the gap for buyers in rural areas where charging infrastructure is sparse. This expands the Total Addressable Market (TAM) significantly beyond coastal cities.

5. Xiaomi EV

The Consumer Electronics Giant Enters the Chat

The Xiaomi SU7 and its 2026 facelift are proving that consumer electronics companies might be better at making modern cars than car companies are.

The SU7 Ultra

Xiaomi is not playing it safe. The SU7 Ultra is a performance monster designed to challenge Porsche, with aggressive aerodynamics and track-level performance. In 2026, keep an eye on their global expansion plans. If Xiaomi manages to navigate import tariffs and enter European or South American markets effectively, their stock (HKG: 1810) could see significant automotive-driven upside.

Financial Intelligence for the EV Era

Understanding the cars is secondary to understanding the money behind them. For 2026, your financial strategy regarding EVs should revolve around three pillars: Financing, Insurance, and Infrastructure.

Structuring EV Auto Loans in 2026

Interest rates have stabilized but remain elevated compared to the pre-2020 era. When financing a vehicle from a startup like Rivian or Lucid, traditional banks may offer higher APRs due to “brand risk.”

- Strategy: Look for “captive finance” offers. These manufacturers often subsidize rates to move metal.

- Residual Value: Be wary of long-term loans (72+ months) on EVs from new brands. Technology evolves so fast that depreciation curves can be steep. Leasing might be the superior financial hedge to protect yourself from plummeting resale values.

Navigating EV Insurance Premiums

Insurance is becoming a major line item in the total cost of ownership. High-performance EVs like the Lucid Air Sapphire or the Afeela 1 are expensive to repair.

- Telematics is King: In 2026, opting into “usage-based insurance” (UBI) programs that monitor your driving data is the most effective way to lower premiums.

- ADAS Discounts: Ensure your insurer explicitly discounts for Level 2 and Level 3 autonomous safety features. The Afeela’s sensor suite should theoretically command a lower risk premium if the data supports it.

Strategic Portfolio Allocation

Don’t just buy the car company; buy the ecosystem.

| Sector | Ticker Symbol Examples | Why Watch in 2026 |

| OEMs | RIVN, LCID, TSLA | High risk, potential for breakout growth as production scales. |

| Charging | CHPT, EVGO | Infrastructure plays are essential as millions of new EVs hit the road. |

| Semiconductors | NVDA, QCOM | The “brains” of the car. Afeela and Xiaomi rely heavily on these chips. |

| Raw Materials | ALB, SQM | Lithium and battery chemistry remains the bottleneck of the industry. |

6. The Wildcards: Canoo and Aptera

Canoo (NASDAQ: GOEV)

Now headquartered in Texas, Canoo has pivoted almost entirely to commercial fleets. Their lifestyle delivery vehicle (LDV) is distinct, pod-like, and maximized for cargo volume.

- The Watch: Can they fulfill their orders for Walmart and the US Army? 2026 is their make-or-break year for commercial viability.

Aptera Motors

Aptera is the efficiency extremist. Their three-wheeled, solar-electric vehicle promises up to 40 miles of range per day just from the sun.

- The Watch: After years of funding hurdles, the “production intent” vehicles are finally visible. This is a niche product, but for investors, it represents a potential licensing goldmine for solar-integration technology.

Conclusion

The year 2026 is when the electric vehicle market grows up. We are moving past the phase of prototypes and promises into an era of production execution and software dominance. For the consumer, it means better choices like the Rivian R2 and the Scout Traveler. For the investor, it means looking at the supply chain—chips, batteries, and insurance—just as closely as the hood ornament.