The transition toward electric mobility has reached a critical inflection point as we enter 2026. For years, the conversation surrounding electric vehicles centered on new car sales and the latest technological breakthroughs. However, the true maturity of the automotive ecosystem is now being defined by the secondary market. As millions of early-adopter leases expire and corporate fleets cycle their inventory, the used electric vehicle sector has transformed from a niche interest into a multi-billion dollar pillar of the global economy.

- The New Reality of 2026: A Recalibrated Landscape

- Financial and Investment Perspectives on Second-Hand Electrification

- Technical Health and Valuation Standards

- Global Market Divergence: China, Europe, and North America

- Infrastructure and Consumer Sentiment as Growth Catalysts

- Future Projections: 2026 and Beyond

Today, on December 30, 2025, we are witnessing a market that has moved past its initial volatility. The wild price swings seen in previous years have been replaced by a more predictable, data-driven environment. This stability is attracting a new wave of institutional investors, specialized financing firms, and a broader consumer base that views a second-hand electric car not just as an environmental choice, but as a superior financial asset.

The New Reality of 2026: A Recalibrated Landscape

The current year has been characterized by what many analysts call a great recalibration. After several years of aggressive government incentives and supply chain constraints, the market has finally found a natural equilibrium. The growth we are observing is no longer fueled solely by subsidies but by the inherent value proposition of the vehicles themselves.

Supply Dynamics and Inventory Fluctuations

Inventory levels for used electric vehicles have reached record highs as we conclude 2025. This surge is primarily attributed to the massive wave of three-year leases that were signed during the peak adoption years of 2022 and 2023. As these contracts end, a diverse array of models is hitting the market, ranging from high-end performance sedans to affordable urban hatchbacks.

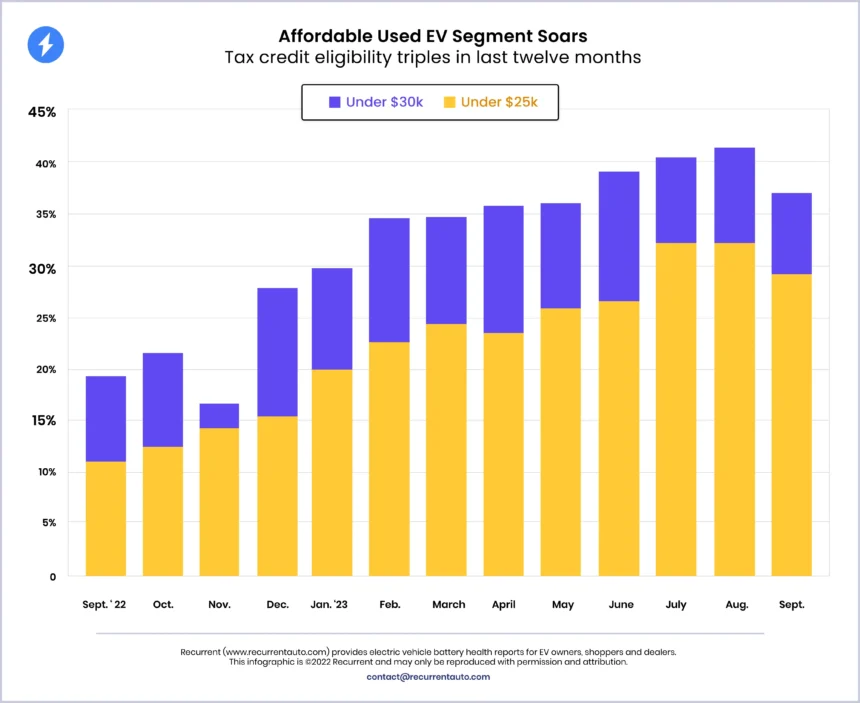

In the United States, the supply of used electric cars has grown by nearly 45 percent over the last twelve months. This increased availability has addressed one of the most significant barriers to entry for many consumers: choice. Buyers are no longer restricted to a handful of models. They can now select from a variety of price points and body styles that cater to specific lifestyle needs.

The Impact of Subsidy Expirations

A defining feature of the late 2025 market has been the expiration of several federal and state-level incentives. The September 30, 2025, deadline for several high-profile tax credits sparked a buying frenzy in the third quarter. This was followed by a brief cooling period in the fourth quarter.

Interestingly, the removal of these “artificial” price supports has had a positive effect on market transparency. Without the complicating factor of tax rebates, the true market value of these vehicles has become easier to calculate. This clarity is essential for dealers and financiers who need to manage risk and set accurate floor prices.

Financial and Investment Perspectives on Second-Hand Electrification

The financial sector has become deeply integrated into the used electric vehicle ecosystem. Banking institutions and independent lenders are now offering sophisticated products specifically designed for the unique lifecycle of an electric powertrain.

Depreciation Curves: Comparing EV vs. ICE in 2026

Historically, electric vehicles were criticized for high depreciation rates. However, data from late 2025 suggests that the gap between electric and internal combustion engine vehicles is narrowing significantly. While early luxury electric models still see a steep initial drop, mass-market models from brands like Tesla, Hyundai, and Ford are holding their value remarkably well.

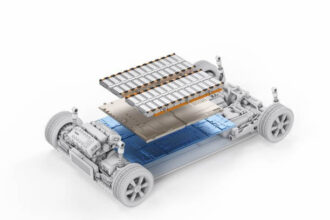

The primary driver of this improved retention is the longevity of the hardware. Unlike traditional engines that have thousands of moving parts subject to mechanical wear, the simplified powertrain of an electric car requires far less maintenance. In 2026, a vehicle with 60,000 miles is no longer viewed with the same skepticism as its gasoline counterpart, provided the battery health remains intact.

| Vehicle Type | Average 3-Year Depreciation (2023) | Average 3-Year Depreciation (2025) |

| Luxury Sedan (Gasoline) | 38% | 40% |

| Mass-Market SUV (Electric) | 48% | 42% |

| Compact Hatchback (Electric) | 52% | 44% |

Financing Strategies and Interest Rate Sensitivity

Financing for used electric vehicles has become a highly competitive sub-sector of the auto loan industry. Lenders are increasingly using sophisticated algorithms to assess the residual value of these assets. These models now incorporate real-time data on battery degradation, software versioning, and charging history.

As interest rates have stabilized in late 2025, we have seen the emergence of “Battery-Backed Loans.” These are financial products where the loan terms are partially tied to the certified health of the battery. A vehicle with a State of Health (SOH) rating above 90 percent can qualify for a lower interest rate, as the asset is considered to have a lower risk of premature obsolescence.

Insurance Risk Profiles and Premium Calculations

The insurance industry is also undergoing a massive shift. In the early days of electrification, premiums were often higher due to the high cost of replacement parts and a lack of historical data. By 2026, the situation has improved. Insurers now have access to years of safety data proving that advanced driver-assistance systems (ADAS) standard in most electric vehicles significantly reduce the frequency of accidents.

However, the cost of repairs remains a point of focus. Because many electric vehicles utilize unibody or large casting construction, even minor structural damage can be expensive to remediate. To address this, specialized insurance providers are offering “Certified Repair Coverage” for used buyers, ensuring that any work is performed by technicians certified to handle high-voltage systems.

Technical Health and Valuation Standards

One of the most significant developments in the used electric vehicle market is the standardization of technical inspections. Gone are the days when a buyer had to guess the remaining life of a car’s battery.

The Evolution of Battery Health Reports

The State of Health (SOH) report has become the “Gold Standard” for transactions in 2026. These reports provide a comprehensive look at the battery’s history, including the number of fast-charging cycles, temperature exposure, and current capacity compared to the original factory specifications.

Major platforms now require a certified battery report before a listing can be verified. This transparency has boosted consumer confidence. Many manufacturers have also extended their battery warranties to the second or even third owner, typically covering the component for up to 8 years or 100,000 miles. This safety net is a critical factor in the rapid growth of the secondary market.

Software-Defined Vehicles and Residual Value

A unique feature of the electric vehicle market is the importance of software. Unlike traditional cars that remain static after they leave the factory, modern electric vehicles receive over-the-air (OTA) updates that can improve performance, add features, and even increase range.

In the 2026 market, a “software-mature” vehicle often commands a premium. Buyers are willing to pay more for a used car that has the latest infotainment system, enhanced safety features, and improved thermal management software. This makes the software version almost as important as the physical mileage of the car.

Global Market Divergence: China, Europe, and North America

While the trend toward electrification is global, the used market is developing differently in various regions.

The Dominance of the Chinese Secondary Market

China remains the world’s largest market for both new and used electric vehicles. In late 2025, China’s secondary market grew by over 50 percent year-on-year. This growth is supported by a massive domestic manufacturing base and a government that has aggressively promoted battery recycling and “second-life” battery applications.

The Chinese market is also characterized by a high turnover rate. Consumers there tend to upgrade their vehicles more frequently, leading to a constant stream of high-quality, late-model used cars entering the market. This has created a vibrant ecosystem of digital platforms dedicated to the inspection and sale of pre-owned electric cars.

Europe’s Regulatory Push and Infrastructure Maturity

In Europe, the growth of the used market is being driven by strict environmental regulations and high fuel prices. Many cities have implemented low-emission zones that effectively ban older internal combustion engine vehicles, leaving consumers with little choice but to go electric.

Europe also leads the way in charging infrastructure maturity. In countries like Norway, the Netherlands, and Germany, the density of public chargers is so high that “range anxiety” has largely disappeared. This infrastructure makes used electric vehicles a viable option even for those who live in apartments without private charging.

Infrastructure and Consumer Sentiment as Growth Catalysts

The success of the second-hand market is inextricably linked to the physical infrastructure that supports it.

Charging Accessibility and Range Confidence

In late 2025, the global network of high-speed chargers has expanded to include nearly every major highway corridor in the industrialized world. The integration of North American Charging Standard (NACS) across most brands has simplified the experience for North American drivers, allowing used cars from different manufacturers to use the same reliable networks.

As charging times have decreased and charger reliability has increased, the psychological barriers to buying a used electric vehicle have faded. Consumers are now more focused on the “Total Cost of Ownership” (TCO) rather than the fear of running out of power.

The Role of Dealerships and Certified Pre-Owned (CPO) Programs

Automobile dealerships have finally embraced the electric transition. Most major manufacturers now have robust Certified Pre-Owned (CPO) programs specifically for their electric lineups. These programs typically include a rigorous 150-point inspection, a guaranteed battery health certificate, and extended warranties.

For many buyers, the CPO route is the preferred way to enter the market. It offers the peace of mind of a new car purchase at a used car price point. Dealerships have also invested heavily in specialized equipment and training for their service departments, ensuring they can support these vehicles long after the initial sale.

Future Projections: 2026 and Beyond

As we look toward the remainder of 2026 and into 2027, the trajectory of the used electric vehicle market remains overwhelmingly positive. Several factors suggest that growth will continue to accelerate:

- Technological Trickle-Down: The advanced battery technologies being introduced in 2026 flagship models will eventually make their way into the secondary market, continually raising the baseline of what a “good” used car looks like.

- Corporate Fleet Turnover: Many large corporations committed to net-zero goals in the early 2020s. Their fleets are now beginning to enter the used market in large volumes, providing a steady supply of well-maintained, high-utility vehicles.

- Battery Circularity: The emergence of a mature battery recycling industry is creating a “floor” for the value of even the oldest electric vehicles. Even if a car is no longer road-worthy, its battery cells have significant value for stationary energy storage or raw material recovery.

The used electric vehicle market has matured into a sophisticated, transparent, and economically vital sector. For the savvy consumer or investor, the current landscape offers a unique combination of technological excellence and financial opportunity. As the global fleet continues to electrify, the secondary market will be the engine that drives mass-market adoption, making sustainable transportation accessible to all.

Sources and Real-Time Data:

- PwC Strategy and Analysis: Global EV Sales Review Q4 2025

- Cox Automotive Industry Insights: 2026 Used Vehicle Market Projections

- S&P Global Mobility: Electric Vehicle Infrastructure and Market Trends

- Alternative Fuels Data Center: Federal and State Incentive Database

- Tesla Support: Certified Pre-Owned and Incentive Information

https://kentshield.online/category/news/ev-market-growth-reports